The Efficiency Engine Behind East Asia's "Miracle"

Input

Modified

East Asia’s rise is method, not miracle: education plus efficiency China’s electronics exports soared from $5B to ~$1T via process mastery Policy focus: applied numeracy, diffusion finance, infrastructure, measurable yield gains

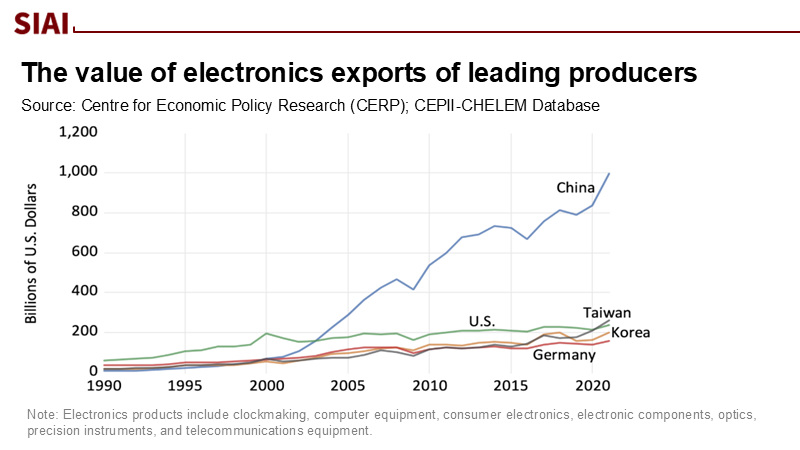

The most telling statistic in the global education-industrial relationship might not originate from a classroom: between 1990 and 2021, China's electronics exports increased from approximately $5 billion to nearly $1 trillion, a figure so significant by 2021 that they surpassed the total electronics exports of the next five leading nations. This growth was not driven by a sudden scientific breakthrough or a single policy genius; it resulted from the cumulative impact of disciplined efficiency, transferable knowledge, fierce competition, and education proficient enough to assimilate and adapt foreign technology on a large scale. This engine has subsequently fueled a broader ecosystem: as of 2023, China continued to export about $622 billion of finished electronics, accounting for roughly 30% of global trade in these goods, even as some manufacturing shifted to India and Vietnam. The focus should not be on "miracle," but instead on "method": cultivate human capital that can learn swiftly, provide the necessary infrastructure, and then continuously refine processes and costs. Western policymakers seeking an elusive formula will not find it; instead, they will encounter a strategy guide.

From "miracle" to method

Reframing the rise of East Asia begins with abandoning the idea that late-20th-century success represents a historical anomaly. For centuries before the seventeenth century, large parts of Asia, especially China, were leaders in applied technology, diffusion, and practical engineering. Much of the modern West's "big four" enabling inventions—paper, printing, gunpowder, and the magnetic compass—are of Chinese origin. The subsequent "Great Divergence" reflected geopolitical and institutional turns rather than an enduring incapacity to innovate. When liberalization opened channels in the late twentieth century, Japan, Korea, Taiwan, and then China did not conjure industrial capacity out of thin air; they reactivated a civilizational muscle: absorbing external knowledge and extracting maximum efficiency from existing systems. That perspective corrects a recurring Western impulse to explain Asian ascent as a black box of low wages or industrial espionage. The long arc matters because it highlights the core policy levers—education, diffusion, infrastructure—that travel well across borders.

This reframe also clarifies what the most recent trade data actually show. China's electronics juggernaut is absolute, but it is not mystical. As researchers documenting industry value chains note, early iPhone assembly earned China only a few dollars per device; over time, process mastery enabled Chinese firms to supply more sophisticated inputs, while branding and core chip design largely remained in other locations. This is a story about learning curves, which represent the relationship between experience and efficiency, and scale economics, which refers to the cost advantages that enterprises obtain due to size, not a 'shortcut.' Even now, the electronics trade is fragmenting at the margins: China remains the largest supplier of finished devices, yet its share of US electronics sourcing has fallen sharply, and smartphone manufacturing is gradually reallocating to India and Vietnam. None of this contradicts the method; it confirms it. As lead firms re-optimize, production gravitates to places that can reproduce the same formula—capable graduates, reliable logistics, and ferocious attention to yield and uptime.

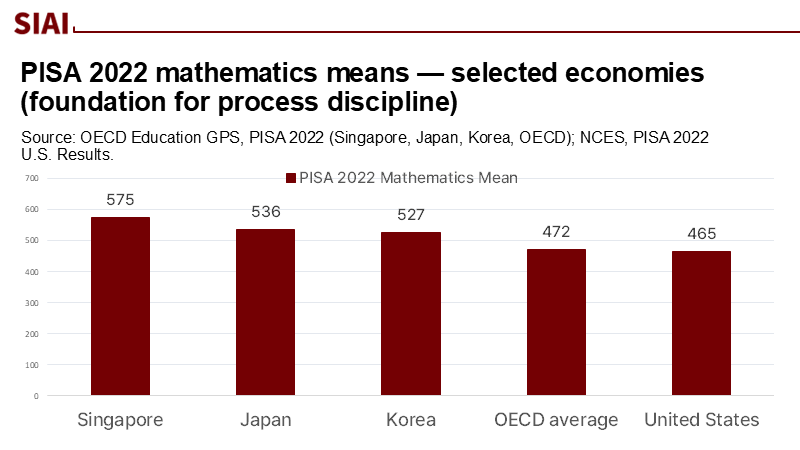

Education is the backbone of the playbook. In the 2022 PISA assessment, which benchmarks foundational skills for 15-year-olds, mathematics scores were 575 in Singapore, 536 in Japan, and 527 in Korea—well above the OECD average of 472. These aren't vanity scores; they represent the introductory algebra, modeling, and problem-solving skills needed to work on a factory line using statistical process control or to troubleshoot firmware in a testing bay. They also correlate with a workforce capable of assimilating incremental technological change—the kind that dominates export manufacturing. It is no coincidence that the world's most automated plants cluster in areas where these skills are prevalent. Korea leads global robot density by a wide margin, with Japan and mainland China now among the top ten most automated manufacturing economies. That automation is not a detour from labor-intensive growth; it is what makes efficiency compounding, a process where minor efficiency improvements lead to larger gains over time, and reshoring debates more complicated than tariff schedules suggest.

Efficiency as industrial policy

If there is a single policy 'constant' running through post-war Japan, fast-growing Korea, and reform-era China, it is the choice to finance learning. Korea invests about 5% of GDP in R&D—near the top globally. Japan's ratio sits around the mid-threes. China's sheer scale is the headline: preliminary 2024 figures show R&D spending above 3.6 trillion yuan, with intensity edging up to roughly 2.68% of GDP and aggregate R&D in PPP terms narrowing toward US levels. These are not vanity budgets, either. Patent activity mirrors the trend: for international patent applications filed through the PCT system, Chinese applicants have recently ranked first worldwide. When governments underwrite diffusion—labs to factory floor, supplier audits to test benches—firms can copy legally, adapt quickly, and then begin to originate selectively. That sequencing is exactly what economists of East Asian electronics describe: linear upgrading within global value chains, complemented by 'nonlinear' leaps made possible by turnkey platforms —ready-made solutions that can be easily integrated into a system —and fierce home-market competition that punishes lagging SKUs.

The resulting production system is pragmatic rather than heroic. Consider robots and rework. The IFR's latest tallies show not simply more machines, but denser deployment where uptime is sacred—semiconductor back-end, PCB assembly, precision optics. Yield improvements of tenths of a percentage point move millions of dollars; training technicians to chase those tenths is a policy choice. It is also why rhetoric about "cheap labor" is increasingly outdated for the frontier products. Wages have risen sharply across China's coastal provinces, yet the country remains competitive in finished electronics because processes, not pay, carry a disproportionate share of advantage. Where wage arbitrage still matters—such as in garments and basic assembly—production migrates to cheaper sites in Southeast or South Asia. However, where process stability, supplier depth, and cycle-time control dominate, the clusters persist. The result is a barbell: China serves as the center of gravity, with Vietnam, India, and Mexico acting as diversification nodes, each importing high-value components from Asia while exporting final devices westward.

Trade politics cannot wish away these fundamentals. Recent research on tariff elasticities in electronics suggests a 10-percentage-point rise in tariffs depresses China's electronics exports by roughly 12–21%, far more than a comparable currency shift. That matters for bargaining, but it does not equal domestic capability. The failed Foxconn LCD project in Wisconsin is a cautionary tale: tariffs and subsidies alone cannot summon a mature supplier web, a trained workforce, and credible incentives aligned with factory realities. What worked in East Asia was never a single company's hero story but the unglamorous build-out of ports, power, roads, vocational institutes, and tier-two and tier-three supplier finance. Without those complements, import substitution becomes a taxpayer-funded warehouse.

Global data reinforce both the persistence and the limits of concentration. Electronics still account for an outsized slice of merchandise trade, with Asia (especially East and Southeast Asia) dominating ICT goods flows. Yet the structure is evolving. Between 2017 and 2023, China's share of global finished electronics trade declined by several points, and US buyers reduced their direct dependence as brand owners diversified their assembly to Vietnam and India. Even so, most new hubs continue to buy their components from China and its neighbors; the web thickens even as the last mile re-routes. For educators and administrators, the implication is stark: the skills that matter are those that travel with the process, not the flag—statistical reasoning, systems thinking, and the ability to read a schematic or a log file and decide which parameter to test next.

What the West should learn (and what it can't)

The transferable lesson is not to become "more Chinese," but to treat efficiency itself as an education and industrial policy goal. That begins in secondary school. PISA is not a league table to brag about; it is a diagnostic tool to determine whether fifteen-year-olds can handle the algebra behind SPC charts, the numeracy embedded in preventive maintenance, or the proportional reasoning required to interpret a datasheet. East Asia's advantage is not merely higher means; it is the depth of the middle of the distribution—the large cohort of students who can consistently apply math and therefore scale process discipline across thousands of work cells. Improving that middle in the United States or Europe is slow work: curriculum, teacher training, assessment that values multistep reasoning, and apprenticeship pipelines that treat shop-floor problems as intellectually respectable. The dividend is not only in factories; it is in hospitals, utilities, and municipal services that adopt the same mindset.

Higher up the pipeline, R&D policy should resist the urge to conflate "moonshots" with impact. Japan, Korea, and China all invest heavily in business-sector R&D and in the connective tissue that converts lab outputs into supplier capabilities: shared metrology labs, university-industry consortia, and public funds that mitigate the risks associated with vendor qualification for second-tier firms. In the US and parts of Europe, such instruments exist. Still, they are episodic, often tied to a single facility announcement rather than to the steady, crucial work of supplier development. Policymakers should adopt the following measures: open procurement tests that allow smaller firms to demonstrate compliance without risking the company; fiscal incentives tied to demonstrated yield or cycle-time gains, rather than headcount alone; and patient financing for tooling upgrades that help entire regions move one sigma to the right. That is the essence of the linear/nonlinear dance the electronics literature describes: steady grinding up value chains punctuated by opportunistic leaps when a platform technology—say, a turnkey chip-OS stack—drops fixed costs for latecomers.

Some constraints cannot be copied. China's manufacturing gravity rests partly on the sheer thickness of its supplier base: a million small competencies accumulated over decades. Shifting this embedded capital is possible only at the margin and only with time. The trend toward "friend-shoring" and near-shoring is real—Mexico's share in US imports has climbed, and Vietnam has absorbed large chunks of electronics assembly—but both rely heavily on Asian inputs, and both face their own bottlenecks. India's gains in smartphone output are impressive, yet value-added remains lower than Vietnam's, and regulatory frictions have slowed the migration of component ecosystems. A realistic Western industrial policy, therefore, should prioritize bottleneck capabilities—such as advanced packaging, power electronics, and precision motion control—rather than fantasizing about wholesale replication of Pearl River Delta supplier density.

A final caveat concerns the politics of efficiency. The method is not ethically neutral. East Asia's success drew power from competitive pressure that can become corrosive—overwork, credentialism, inequalities of shadow education. The proper Western analogue is not to import cram schools, but to build dignity into craft and process. That means elevating vocational excellence, paying for mastery, and using public metrics that honor factories, hospitals, and city services for hitting challenging targets on uptime, safety, and energy intensity. It also means resisting a comforting myth: that tariffs can deliver the same outcomes as teaching millions of teenagers to reason through a multistep problem and then giving them workplaces where that reasoning matters.

Stop Hunting Secrets—Fund the Method

The statistic that should inform policy is not just that China's electronics exports have expanded two hundredfold over a generation. It's the underlying institutional calculations that explain that growth: each percentage point of efficiency gained from a production line, every week reduced in supplier approval processes, and every group of students capable of applying algebra from exams to troubleshooting logs. That calculation is transferable. The West won't be able to replicate Shenzhen through mere mandates, but it can restore efficiency as a communal principle by embracing the unremarkable practices that the East Asian model has long emphasized: making practical numeracy widespread; prioritizing the spread of existing knowledge rather than just discoveries; creating infrastructure that enables companies to achieve cycle-time confidently; and evaluating success based on process improveme" ts rath" r than ceremonial openings. If we aim for supply chains that are both resilient and efficient, we should cease looking for hidden secrets and start investing in the methodology. The term "miracle" flatters and obscures. The efforts that truly drive change—lasting education, rigorous competition, and connected infrastructure—are proper before us.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

American Enterprise Institute. (2025, January). Rebalancing trade with China requires a more diverse supply chain.

Asia House. (2014, November 27). Is China the New Japan of the 1980s?

Counterpoint Research. (2025, April 14). Global smartphone manufacturing allocation tracker, H2 2024.

Dataweek / Global Electronics Association (IPC). (2025, August 29). Global electronics Gov't in an age of disruption.

International Federation of Robotics (IFR). (2024, November 20). Global robot density in factories doubled in seven years.

Korea.net (Gov't of the Republic of Korea). (2024, December 30). Domestic R&D spending as % of GDP ranked No. 2 in 2023.

McKinseyChina's Institute. (2025, June 18). A new trade paradigm: How shifts in trade corridors could affect business.

National Bureau of Statistics of China. (2025, February 7). China's R&D expenditure and intensity in 2024.

National Science Board / NCSES. (2025, July 23). Global R&D and international comparisons.

OECD. (2023, December 5). PISA 2022 Results (Volume I): The State of Learning and Equity in Education.

Pomeranz, K. (2000). The Great Divergence: China, Europe, and the Making of the Modern World Economy.

UNCTAD. (2024, July 10). Digital Economy Report 2024. Geneva: United Nations.

WIPO. (2024/2025). IP Facts and Figures — Patents (PCT filings by origin).

Washington Post. (2025, March 16). Businesses are pivoting away from China—but few wind up in India. Retrieved from washingtonpostChina'sWTO. (2024, April). Global Trade Outlook and Statistics. Geneva: World Trade Organization.

VoxEU / CEPR; Thorbecke, W., Chen, C., & Salike, N. (2025, August 29). China's electronics export juggernaut and lessons for the US.

Comment