From Lending Apps to Settlement Rails: Why Stablecoin Banking Will Define the Next Decade

Published

Modified

Stablecoin banking—not lending apps—now drives the real contest over payment infrastructure Stablecoins move trillions monthly as regulation and instant domestic rails converge Universities should pilot cross-border stablecoin payments and teach the operational playbook

The most critical number in finance that barely makes the evening news is this: in 2025, dollar-pegged stablecoins moved more than $2 trillion per month on public blockchains, with peaks near $4 trillion. That flow is not the same as card purchase volume, and it isn’t all consumer spending. However, it sends a clear signal that value is already moving to new settlement systems globally. The old debate about whether fintech lenders would replace banks missed the mark. The real competition is about settlement infrastructure, and here things have changed. Banks are not being overwhelmed by lending apps. They are adopting the best fintech ideas, modernizing their systems, and connecting to instant networks. Meanwhile, stablecoin banking, which consists of regulated digital dollars with bank-level controls, has emerged as the fastest-growing neutral layer for transferring money across borders and platforms. The question now is not about disruption versus defense. It is whether policy will urgently shape this new structure to benefit learners, institutions, and the broader economy.

Over the past two years, traditional banks have learned to follow the fintech playbook where it counts: speed, data portability, and embedded finance. Fintech continues to grow, but in specific areas. A 2025 global review estimates that fintechs have captured only about 3% of banking and insurance revenues, even as larger players report substantial profits and 21% revenue growth in 2024. Traditional banks hold the upper hand in funding and distribution; fintechs succeed where banks have been slow, uncompetitive, or restricted. Lending platforms now provide assets to private credit funds, bank treasuries handle real-time payments facilitated by instant networks, and payment networks are experimenting with on-chain settlement. The story is no longer “banks versus fintech,” but a race to build a unified system where regulated deposits, instant networks that enable real-time transactions, and tokenized dollars work together.

Stablecoin banking is a settlement layer, not a bank killer

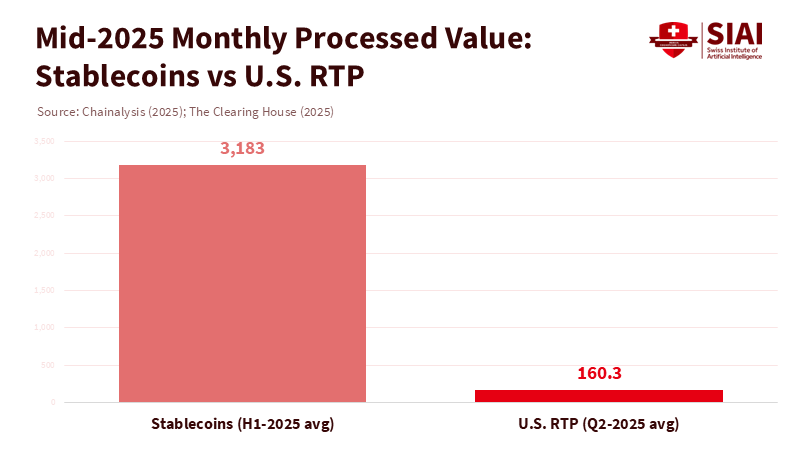

If lending was the first act, settlement is the next. Consider three facts. First, fintech lending remains small compared to the broader system: about $500 billion in outstanding fintech-originated loans globally, versus $18 trillion in U.S. household debt alone. Second, banks have developed instant payment systems: The Clearing House’s RTP network processed $481 billion in Q2 2025, and the FedNow Service reported over 1,300 participating institutions as of April 2025, with growth continuing through mid-year. Third, the market cap of stablecoins reached a record of around $252 billion in June 2025 as lawmakers began advancing specific regulations. The pattern is clear. Banks maintain their balance sheets and regulatory perimeter, fintechs expand into new areas, and stablecoins and tokenized deposits begin to weave the middle, acting as programmable settlement assets that are accessible across platforms and time zones.

Mainstream payment networks are also normalizing these systems. Visa now supports stablecoin settlements using USDC and continues to expand its support for various chains and assets. Mastercard has extended its partnership with Circle to allow USDC settlements in parts of EEMEA. These are not just crypto experiments. They represent gradual improvements in how payment processors fund and settle transactions, especially across borders and over weekends when traditional correspondent systems can be slow or costly. With each pilot and regional rollout, on-chain dollars gain legitimate off-ramps and risk frameworks. This doesn’t make banks obsolete. Instead, it positions them as gateways and protectors for a more open settlement structure, where stablecoin banking becomes a feature of the system, not a threat to it.

The case for stablecoin banking, focusing on cost, speed, and reach

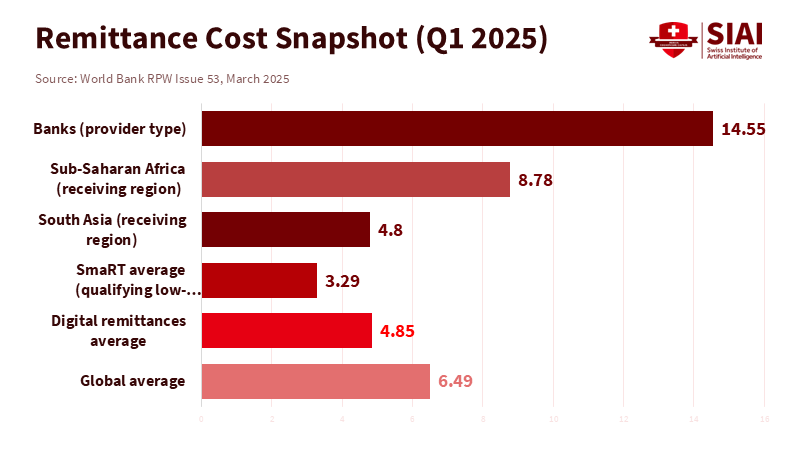

Cross-border fees are a primary policy issue that stablecoin systems can address. The World Bank’s Remittance Prices Worldwide reports the global average remittance fee at about 6.49% in 2025, far above the SDG target of 3%. Stablecoins will not automatically solve compliance issues or foreign exchange spreads, and not every region is ready for change. However, programmable dollars can reduce settlement delays and eliminate gaps on weekends or holidays. They also allow for 24/7 treasury operations that synchronize with instant domestic clearing. As networks enable pre-funded redemptions and improved liquidity management, total costs can decrease in regions where correspondent systems are weakest. For education finance, this could mean lower international tuition fees, faster refunds, and smoother payments to students and researchers living across borders.

Scale and regulation are coming together. Chainalysis estimates that stablecoins account for a majority of on-chain transaction value, with monthly transfers in 2025 consistently exceeding $2 trillion. Meanwhile, the EU’s MiCA regulations applied full reserve and redemption rules to stablecoins starting June 30, 2024. Regulators have been refining liquidity standards throughout 2025. In the U.S., a Senate-passed bill in mid-2025 proposed rules for liquidity-backed reserves and monthly disclosures for issuers.

Additionally, open banking rules—essential for data portability and compliance—are undergoing revisions and legal challenges. The signal is not confusing. It is convergence: the same risks will have the same rules for digital dollars, classified by their function, and tied to bank-level safeguards.

A practical policy framework for stablecoin banking

Treat stablecoins as payment tools rather than shadow deposits, which are unregulated and non-bank entities that perform bank-like functions, and regulate them accordingly. Europe’s MiCA places e-money-style responsibilities on fiat-pegged tokens, including authorization, high-quality reserves, redemption at par, and regular disclosures. This model, adapted to local laws, should guide issuance and oversight elsewhere. In practice, this means licensing issuers, enforcing separate reserves in Treasury bills and cash, requiring independent verification, and establishing sensible stress-redemption rules. It also means aligning wallet providers and off-ramps with existing anti-money laundering and counter-terrorism financing obligations, ensuring compliance with Travel Rule standards similar to those for wire transfers. If this is done, stablecoin banking can become a safe, straightforward utility that decreases friction while maintaining consumer protection.

Build the interoperable system. On the bank side, establish lasting data-sharing standards so that know-your-customer checks, sanctions screening, and transaction oversight can accompany payments. The CFPB’s open banking rule was finalized in 2024 and is under review in 2025; the outcome should ensure secure API access while balancing costs and liabilities. Regarding payments, synchronize instant payment networks (like RTP and FedNow) with on-chain settlements so that institutions can manage incoming stablecoin receipts in insured deposits in real time and vice versa. On the partnership side, enforce the 2024 U.S. interagency guidance on third-party risk to ensure that bank-fintech collaborations tighten control rather than loosen it. The goal is not about adhering to ideological beliefs. It is about creating a system where each part—deposits, instant networks, and tokenized settlement assets—performs its best function under clear rules.

What stablecoin banking means for education leaders

University CFOs and bursars should focus on practical applications rather than ideology. Cross-border tuition and refunds present an easy opportunity. If a school already accepts wire transfers and credit cards, integrating a stablecoin-to-treasury process through a regulated payment provider can reduce delays and minimize failed transactions for students without access to hard currency accounts. The setup is straightforward: accept USDC or similar regulated tokens, clear anti-money laundering and Travel Rule checks, automatically convert to local currency or transfer to insured deposits, and reconcile through standard ERP processes. This does not involve holding volatile cryptocurrencies. It is about using a programmable, always-available settlement tool at the edge while keeping cash management and reporting at the core. With instant networks, refunds can arrive the same day instead of taking weeks. This is a service improvement students will notice.

For academic leaders, closing the curriculum gap is crucial. Graduates in business, public policy, and computer science will navigate a world where stablecoin banking and tokenized deposits are common. Programs should cover practical realities: how reserves function, what Travel Rule data looks like, how sanctions screening works, why on-chain transfers differ from credit card transactions, what MiCA and U.S. regulations require, and how to analyze the total cost of ownership between on-chain and correspondent systems. Compliance and risk teams should also be trained to this standard. The market will not wait, nor will students who need faster, more affordable financial access across borders. When policies clarify and controls strengthen, institutions that begin pilot programs now will be better positioned to scale smoothly.

The figure that started this column indicates a shift. Trillions in monthly on-chain transfers show that the world has already begun testing a new settlement system. Banks did not lose the lending battle. They adapted, collaborated, and updated. The next decade will depend on how well we govern the connections linking them to the open internet of value. Ensure stablecoins are safe, straightforward, and widely accepted—through licensed issuance, high-quality reserves, instant redemption, supervision for wallets and off-ramps, and open banking data channels—so that “crypto” becomes basic infrastructure. Education leaders should take action: test cross-border tuition and refund systems with regulated providers. Teach students the practical workings of this infrastructure. Urge policymakers to synchronize standards so that instant domestic payments and stablecoin banking support each other instead of competing. If we move forward this way, the trillion-dollar number will be more than just interesting. It will become the foundation of a fairer, faster financial system that serves learners first.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Adyen. (2025). Fintech you can bank on: How global banking infrastructure sets fintech apart. Retrieved July 2025.

BCG & QED Investors. (2025, June 2). Fintech’s Next Chapter: Scaled Winners and Emerging Disruptors. (Global Fintech 2025).

BIS (Ahmed, R., et al.). (2025). Stablecoins and safe asset prices (BIS Working Paper No. 1270).

Chainalysis. (2025, Jan. 15). 2025 Crypto Crime Trends: Introduction.

Chainalysis. (2025, Sept. 2). 2025 Global Crypto Adoption Index.

Consumer Financial Protection Bureau. (2024, Oct. 22). CFPB finalizes Personal Financial Data Rights rule.

Consumer Financial Protection Bureau. (2025). Personal Financial Data Rights—Reconsideration and updates.

EBA. (2025, Oct. 10). Opinions on MiCA liquidity requirements for reserve assets.

ESMA. (2023–2025). Markets in Crypto-Assets (MiCA) implementation timeline and measures.

FDIC, Federal Reserve, & OCC. (2024, July 25). Joint statement on banks’ arrangements with third parties.

FedNow Service. (2025, Apr. 16). Continues momentum: 1,300+ participating institutions.

Mastercard. (2025, Aug. 26). Expands partnership with Circle to transform digital settlement in EEMEA.

The Clearing House. (2025, July 17). RTP network Q2 2025 value surge to $481B; 107M transactions.

Visa. (2023, Sept. 5). Expands stablecoin settlement to Solana; partners with Worldpay and Nuvei.

Visa. (2025, July 31). Expands stablecoin settlement support: more chains and use-cases.

World Bank. (2025). Remittance Prices Worldwide (Issue 49; global average ~6.49%).