China's Reserve-Currency Test Will Be Won, or Lost, on Stablecoins

Input

Modified

Stablecoins are the battleground for China’s reserve-currency bid Without a trusted RMB token, dollar stablecoins entrench dominance and siphon savings Use Hong Kong and mBridge to launch audited RMB rails for trade and tuition

It is challenging to reconcile the two figures present in 2025. China is the world's leading manufacturer, contributing trillions of dollars in value and accounting for a significant portion of global industrial output. However, when money crosses borders, the renminbi remains a minor player. In June and July 2025, it accounted for approximately 2.9% of global payments by value on SWIFT, ranking sixth worldwide and trailing behind the U.S. dollar. In contrast, dollar stablecoins—private, tokenized versions of the U.S. dollar—have become critical for facilitating real commerce and savings. Their market value has exceeded $230 billion, with year-on-year growth fueled by demand from emerging markets. Simply put, China excels at producing goods, but the dollar—now in programmable form—still oversees global transactions. If Beijing aims for actual reserve-currency status, the key battle lies not in manufacturing but in designing and governing stablecoins, facilitating cross-border settlements, and preventing domestic savings from shifting into tokenized dollars.

Manufacturing strength without monetary influence

It's commonly believed that industrial prowess naturally leads to financial dominance. However, history tells a more complex story. The last major shift in currency leadership—from the pound to the dollar—didn't start after World War II, but in the 1920s. During that period, networked finance, deep capital markets, and policy choices became as crucial as factories. Today, China's manufacturing leadership hasn't translated into increased use of the renminbi as a payment or reserve asset. The dollar's dominance is bolstered by tokenized dollars that settle transactions in minutes and seamlessly connect to the global cryptocurrency and finance ecosystem. The lesson is clear: while production capacity is essential, trustworthy, programmable money is vital.

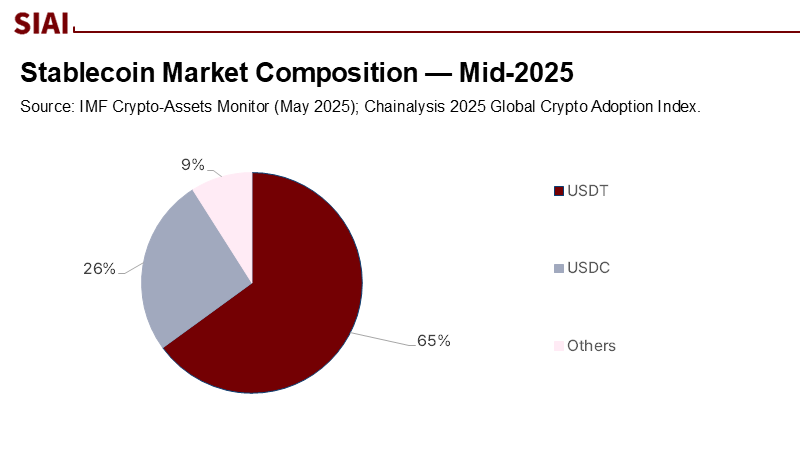

Reframing this debate is essential now, as the underlying infrastructure is rapidly evolving. IMF researchers predict approximately $2 trillion in stablecoin transactions by 2024, with Asia and the Pacific contributing over half a trillion and China-linked flows (both in and out) around $84 billion. By mid-2025, USDT and USDC combined held over $215 billion in market value, with Tether claiming nearly two-thirds of the market. Stablecoins are already being used for cross-border trade solutions where banks are either slow or sanctioned. Suppose China reduces this issue to a straightforward "ban versus allow" choice. In that case, it risks permitting tokenized dollars to gain a stronger foothold in Chinese commerce through gray channels, while renminbi instruments remain inaccessible.

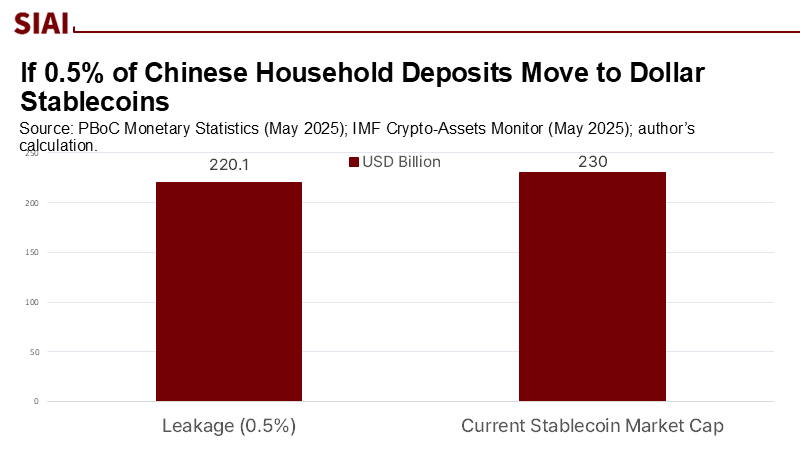

The domestic risk is real. Household deposits in China total well over 300 trillion yuan, with deposit rates this year dropping below 1% in some cases. If just half a percent of these deposits sought safety or utility in dollar stablecoins, it could mean around 1.6 trillion yuan—more than $200 billion at recent exchange rates—shifting towards tokenized dollars. This amount is nearly equal to the current stablecoin market. We base our calculation on 0.5% of the People's Bank of China (PBoC)-reported outstanding deposits (approximately 317 trillion yuan at the end of May), then divide by about 7.2 RMB/USD. The point is clear, though not precise: small percentage movements in such a large pool can influence global markets and reinforce dollar-token dominance domestically.

The cards on the table: Hong Kong, e-CNY, mBridge—and the oil trade

China has a few active policy tools. First is Hong Kong. In August 2025, the city implemented a stablecoin ordinance and licensing regime, addressing fiat-referenced stablecoins, issuer reserves, disclosures, and oversight. Beijing can use Hong Kong as a controlled, regulated corridor for yuan- and HKD-pegged stablecoins while maintaining strict capital controls on the mainland. This is the emerging strategy that industry players anticipate, with major Chinese platforms pushing for offshore RMB-stablecoins to challenge the dominance of dollar tokens. A measured Hong Kong approach provides China with an opportunity to learn by doing, without exposing the mainland to excessive risk.

Second is the digital yuan itself. The e-CNY is currently the largest CBDC pilot globally by transaction value, surpassing 7 trillion yuan in cumulative usage by mid-2024. However, the e-CNY is tailored for retail and domestic payments and cannot serve as an interest-bearing asset by policy. By itself, it won't replace dollar stablecoins in cross-border B2B settlement, where programmable escrow, on-chain foreign exchange, and instant delivery are appealing. For more extensive cross-border settlement, the mBridge project—currently at the minimum viable product stage—provides a shared platform for multi-CBDC payments. Even with the Bank for International Settlements stepping back from daily oversight last year, participating central banks are continuing their pilot programs. This means that for Beijing, there are two approaches: a domestic CBDC for retail and a permissioned cross-border CBDC platform for banks and corporations.

Third is commodity settlement. The so-called "petro-yuan" is more of an ambition than a reality, but signs of progress exist. The yuan is already a significant settlement currency in China-Russia trade, with reports suggesting that crypto and stablecoins have helped facilitate sanctioned energy transactions. Standard Chartered predicts that stablecoins could reach about $2 trillion by 2028. The U.S. has adopted a friendlier policy with a federal stablecoin framework, which would direct more reserves into U.S. Treasury bills and, paradoxically, enhance the dollar's digital presence. If China seeks an alternative path, a fully reserved, transparently audited RMB-backed stablecoin offered by licensed Hong Kong issuers for energy trade invoices is the most direct opportunity. The cost of doing nothing is watching tokenized dollars gain traction in commodity settlements, one invoice at a time.

The challenge for policy design is to prevent capital flight. One feasible solution is a 'two-tier RMB stablecoin.' For tier one, licensed issuers in Hong Kong create RMB-stablecoins against segregated reserves held as PBoC bills and short-term onshore assets through a custodian structure supervised by the mainland, ensuring daily transparency and redemption at par in offshore CNH. For tier two, specific use-case restrictions and programmable controls would limit retail mainland usage while allowing trade finance, tuition payments, and invoice settlements for qualified enterprises and institutions. Redemption periods, circuit breakers, and quotas can help manage chaotic flows during times of stress. This structure draws from the mBridge governance model and money-market fund regulations, focusing on convertibility discipline rather than yield. It isn't sophisticated; it's practical.

What it means for education: campus treasurers, classrooms, and cross-border students

An education journal may seem like an unusual platform for a reserve-currency discussion until you consider where programmable money first takes effect. Universities and vocational institutes are cross-border entities. They collect tuition from international students, pay visiting scholars, license research, fund fieldwork, and purchase specialized equipment from abroad. Tokenized dollars already minimize friction in many of these transactions. If Chinese institutions lack an RMB alternative, they will default to dollar systems out of convenience. Hong Kong's new regulations offer an opportunity to test RMB-stablecoin tuition and scholarship distributions for Chinese nationals studying in Asia, while maintaining strict compliance and verifiable records. For bursars, CFOs, and international offices, the main benefit is operational: predictable settlements, reduced fees, programmable refunds, and automated reconciliations.

The quantitative case continues to strengthen. IMF data indicate that the stablecoin market value will exceed $230 billion by mid-2025, with USDT holding approximately 65% of the market share and USDC accounting for nearly 26%. Chainalysis finds that in countries with capital controls or high inflation, stablecoins often dominate crypto activity: around 62% of stablecoin transactions in Argentina and stablecoin purchases in Turkey were observed at over 4% of GDP at one point in 2023 and 2024. In practical terms, this means international students from these economies are already accustomed to holding value in tokenized dollars, and vendors are learning to accept them. If Chinese campuses cannot provide compliant RMB-token options for fees, stipends, or alum donations, they will inevitably incorporate dollar systems into their own financial operations. This isn't hypothetical; it's the path of least resistance.

For educators, the implications for curricula are immediate. Finance and policy programs should cover "hybrid monetary systems," where public money (CBDCs, central bank reserves) coexists with private money (stablecoins), and where governance, rather than slogans, dictates outcomes. Students need to learn how reserves, audits, redemption rights, and programmable constraints shape user trust. Computer science courses should include secure wallet design and key management specific to institutional contexts; law schools should investigate how licensing, disclosures, and cross-border data sharing can protect consumers while encouraging innovation. In executive education, bursars and administrators require scenarios to practice processes, including handling an RMB-stablecoin tuition refund, conducting on-chain sanctions screening, accounting for tokenized reserves, and responding to a stablecoin losing its peg. These are teachable, practical challenges.

Policymakers overseeing education should work collaboratively. Start modestly with regulatory sandboxes that allow accredited institutions to settle limited cross-border invoices or tuition amounts in RMB-stablecoins through licensed Hong Kong issuers, with strict reporting requirements. Support scholarship foundations in piloting programmable disbursements that activate when visas get approved or credits are earned. Mandate any campus using stablecoins to publish quarterly audits, redemption tests, and consumer protection outcomes. The public sector should set the basic standards—capital, liquidity, disclosures—and allow institutions to compete on service quality, not regulatory loopholes.

Anticipate criticisms. One concern is that stablecoins could facilitate illegal finance. This risk is real and has already been mitigated in the dollar-token system. The appropriate response is not to ban them but to improve the tools available: implement address screening, establish guidelines for redemptions, ensure compliance with travel rules, and provide clear reserve attestations. Another critique is that the renminbi still accounts for roughly 3% of payments, which suggests that network effects will hinder any recovery. The counterargument is historical and technical. Currency hierarchies can shift faster than anticipated with changes to the underlying infrastructure, and tokenization represents such a change. The dollar surpassed sterling sooner than the textbooks suggest because network systems and policies aligned. The renminbi might not replace the dollar, but it can secure a significant share if it presents a trustworthy, programmable alternative that holds advantages in regional trade, educational ties, and Belt and Road services. The goal is not to replace the dollar but to avoid locking in tokenized dollars.

A final objection is that China risks creating its own dollarization if it opens any stablecoin channels. That's why the Hong Kong approach, coupled with quotas and circuit breakers, makes sense. The experiences of Turkey and Argentina illustrate how quickly households can shift to dollar-denominated tokens when inflation surges or access to local currency is restricted. While China's macro conditions differ—facing deflationary pressure rather than rampant inflation—declining deposit rates and a still-weak property market could drive savers toward any asset perceived as safe and usable. The solution is to make the RMB version secure, usable, and clearly defined, while enhancing domestic investment opportunities so that households are not tempted to safeguard their wealth in dollar-denominated tokens.

The choice is clear

Returning to the initial discrepancy, a country that manufactures a large portion of the world's goods controls less than 3% of global payment flows by value, with an increasing share of digital money taking a dollar form that relies less on U.S. banks. This poses a risk for Beijing: a gradual, grassroots "token dollarization" driven by convenience rather than ideology. However, this choice also presents an opportunity. Develop, under Hong Kong's new structure, a fully reserved, auditable RMB-stablecoin that institutions can leverage. Enhance mBridge with functional pathways for education and trade, and establish clear boundaries to safeguard the domestic savings pool. For universities and education ministries, the imperative is to prepare by updating treasury strategies, educating staff on the mechanisms of programmable money, and conducting tests of limited, supervised use cases that lower expenses and increase visibility.

If China sees stablecoins as a threat to be eliminated, the dollar will solidify its lead on the very systems that shape the future of payments. If China views them as design and governance challenges to tackle—using Hong Kong as a controlled environment, mBridge as wholesale pathways, and e-CNY as the domestic backbone—it can bridge the gap between what it manufactures and how the world pays for it. That is the test of reserve-currency status this decade. The time to act is now.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Atlantic Council. “Central Bank Digital Currency Tracker.” (Accessed Sept. 5, 2025).

Bank for International Settlements (BIS). “Project mBridge reached the minimum viable product stage.” Nov. 11, 2024.

BIS. Project mBridge: Connecting economies through CBDC. 2022.

Chainalysis. “2024 Latin America Crypto Adoption: The Rise of Stablecoins.” Oct. 9, 2024.

Chainalysis. “2025 Global Crypto Adoption Index.” Sept. 2025.

Eichengreen, Barry; Chitu, Livia; Mehl, Arnaud. “When did the dollar overtake sterling as the leading international currency?” 2012.

Hong Kong Monetary Authority (HKMA). “Alleged Issuance of Stablecoins in Hong Kong.”

HKMA. “Central Bank Digital Currency—Project mBridge.” Press release, Oct. 26, 2022.

IMF. Crypto-Assets Monitor: 2Q25. May 23, 2025.

IMF Working Paper 25/141. Reuter, Marco. Decrypting Crypto: How to Estimate International Stablecoin Flows. July 11, 2025.

J.P. Morgan / Reuters. “JPMorgan wary of stablecoin’s trillion-dollar growth bets.” July 3, 2025.

Reuters. “Russia, China turn to digital payments as sanctions hamper trade settlements.” July 25, 2024.

Reuters Breakingviews. “China’s stablecoin push is better late than never.” Aug. 22, 2025.

Standard Chartered via Bloomberg. “Stablecoin sector may reach $2 trillion by 2028.” Apr. 15, 2025.

SWIFT. RMB Tracker (June–Aug. 2025 issues).

The Economy. “A Dual-Rail Fix for China’s Dollar Dilemma.” Aug. 25, 2025; “Japan on the Verge of Stablecoin Issuance…”

U.S. Federal Policy Coverage (Reuters/FT). “Stablecoins entering financial mainstream amid U.S. federal framework,” June–Aug. 2025.

Visual summaries of manufacturing shares (2023 data); corroborated by major outlets on China’s industrial dominance.

Comment