Two Rails, One Race: Why Hong Kong's HKD and Japan's Yen Are Asia's Only Real Counters to a US-Led Stablecoin Future

Input

Modified

Dollar stablecoins hold near-total global dominance Only HKD and JPY can credibly counter in Asia Success depends on fast, disciplined execution

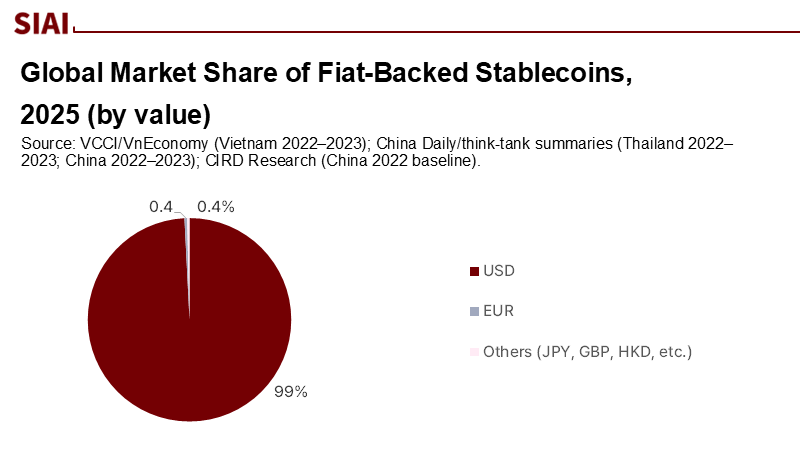

By mid-2025, over 99% of the fiat-backed stablecoin market value will be in US dollars, with a small share in other currencies. US federal legislation has solidified this dominance. Meanwhile, stablecoin settlements are projected to reach trillions of dollars in 2024, with the Asia-Pacific region contributing nearly half a trillion dollars in cross-border transactions. The focus in Asia has shifted to whether alternatives to the dollar can emerge, with only Hong Kong and Japan positioned to compete—Hong Kong using HKD-pegged stablecoins as a "proxy dollar," and Japan leveraging its government bond market for a yen-based coin. Other alternatives are secondary.

Reframing the Contest: From "Crypto vs. CBDC" to "Currency vs. Currency"

The usual framing pits private stablecoins against central bank digital currencies as if they were substitutes. That misses the point. The contest that matters is between currencies, not technologies, and it will be decided on the credibility of reserves, the clarity of rules, and the breadth of use cases. In the United States, the new federal stablecoin statute—referred to in market commentary and Treasury materials as the GENIUS Act—provides a national template, encouraging issuers to adopt bank-quality oversight while facilitating distribution through mainstream financial channels. The result is straightforward: dollar rails get faster and safer, pulling liquidity toward instruments that already back more than $120 billion in US T-bills and clear tens of billions in daily volume. Asia's response must therefore be currency-anchored and institution-led, not app-first. That is why Hong Kong's licensing regime and Japan's revisions to the Payment Services Act matter; they are not crypto experiments, but monetary policy tools for a tokenized age.

Hong Kong's HKD Gambit: A Supervised Proxy for the Offshore Dollar

Hong Kong has implemented a comprehensive licensing regime for fiat-referenced stablecoin issuers under its new Stablecoins Ordinance (effective August 1, 2025), which places reserves, redemption, governance, and disclosure under the supervision of the Hong Kong Monetary Authority. This sits atop live pilots for an e-HKD and the mBridge multi-CBDC corridor, giving regulators a stack that can segment use: retail experimentation via e-HKD, wholesale settlement via mBridge, and private-sector issuance via HKD-pegged stablecoins that inherit the credibly defended 7.75–7.85 peg. For Asia's corporates and treasurers, an HKD stablecoin licenses a familiar settlement asset whose price stability is ultimately underwritten by a four-decade currency board, but with the programmability and atomic settlement that turn tokenized invoices and DvP transactions from slides into routines. Properly designed, it is a "synthetic dollar" with a regulator, not a loophole with a logo.

A simple way to assess the potential is to size a conservative trade settlement slice. China's 2024 exports were roughly $3.58 trillion. Suppose only 3% of those exports—channeled through Hong Kong's established RMB and CNH infrastructure—migrated to HKD-stablecoin settlement by 2027. That would route about $107 billion annually across supervised rails, enough to develop deep secondary markets in tokenized invoices, escrow, and collateral, yet small enough to respect capital controls on the mainland. The point is not prediction, but proportion: a single-digit share can have a significant impact on liquidity. With licensing guardrails—such as daily reserve reporting, independent attestations, and instant redemption within banking hours—the risk profile becomes legible to banks, auditors, and regulators, which is precisely the threshold at which "crypto speed" becomes "financial plumbing."

Japan's Second Wave: The Yen as a Safe Anchor for Tokenized Money

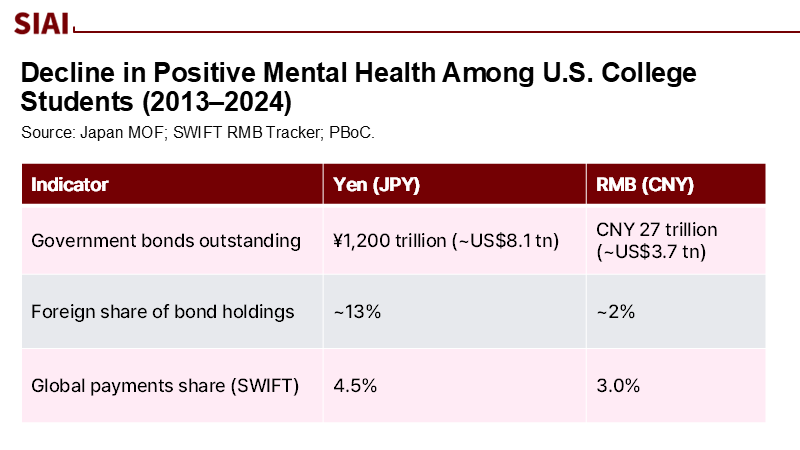

Japan has created a legal framework for fiat-pegged stablecoins, classifying them as "currency-denominated assets" under a revised Payment Services Act. This allows banks, trust companies, and licensed money transfer firms to issue stablecoins. In August 2025, JPYC became the first to receive a license for a yen-pegged coin, promoting a yen stablecoin ecosystem for remittances and on-chain finance. The credibility of the yen in this context comes from the immense and liquid Japanese government bond (JGB) market, exceeding ¥1,200 trillion (US$8.1 trillion) and attracting global investors. Despite recent market volatility, foreign interest remains strong, aided by currency-hedged returns.

However, concerns about who will absorb duration risk arise as the Bank of Japan reduces purchases, emphasizing the need for reserves to match liabilities. A narrow duration strategy, utilizing liquid assets such as cash and short-term JGBs, minimizes risk. Japan’s established prudential regime and high-quality collateral provide the reliability that merchants and remitters seek, reinforcing the yen's role as a "boringly safe" option in the stablecoin landscape.

Will China Buy Time with Hong Kong—Or Try a Yuan Stablecoin?

Beijing is considering yuan-backed stablecoins, marking a significant shift from its 2021 crackdown on crypto. Likely to be tested in Hong Kong, this move aims to hedge against increasing informal use of dollar stablecoins by Chinese exporters and households. Additionally, wholesale CBDC projects like mBridge—achieving its MVP in 2024—can facilitate bank-mediated, cross-border settlements while maintaining jurisdictional control.

Despite RMB's global payment share being stagnant at around 3%, foreign holdings of Chinese bonds are increasing, indicating some demand. The main constraints on the RMB as a settlement asset are capital controls and its limited role in global payments. An HKD-referenced coin, under Hong Kong law, could act as a bridge, balancing dollar stability through the peg and local supervision, without undermining the dollar.

The US Is Not Waiting: Policy Clarity as Competitive Advantage

Every network rewards first movers who professionalize quickly. US policy has shifted from debate to deployment, marked by federal statutes and evolving reserve standards, alongside discussions with banks regarding interest for stablecoin holders. The key issue is whether standardized and transparent reserves, subject to stress testing, can integrate stablecoins into capital markets, increasing demand for US Treasuries and enhancing collateral depth.

To compete, Hong Kong and Japan must act now at an institutional level, adhering to a proven playbook: strict reserve composition, audited custody, instant redemption at par, narrow duration, and daily disclosures. While the US sees tens of billions in weekly volumes for regulated dollar coins, non-USD coins lag significantly. Asia needs both a product and a standard to establish itself as a counterweight, with HKD and JPY fulfilling the product role and local statutes providing the necessary standard.

Method, Uncertainty, and What to Watch

The quantitative claims here rest on three main principles. First, rely on primary sources for complex numbers: SWIFT for RMB payment share, Japan's Ministry of Finance for JGB data, and HKMA and BIS for milestones. Second, triangulate available aggregates using independent series like Visa-style flows and IMF papers. Third, provide transparent estimates when no direct statistics exist, exemplified by the 3% HKD-stablecoin scenario for China's 2024 exports using UN COMTRADE data.

To falsify the thesis, three developments could emerge: a retreat in US policy that narrows the dollar's advantage, restrictive licensing in Hong Kong limiting the distribution of HKD coins, or a decline in Japan's JGB market credibility. Key indicators to monitor include US bank lobbying on interest-bearing designs, HKMA guidelines on reserve composition, and JGB auction coverage ratios. Currently, none of these are decisive enough to change the landscape; execution remains critical.

What Educators, Administrators, and Policymakers Should Do Now

Universities and training providers should stop treating "crypto" as a monolith and instead teach tokenized finance as a form of monetary infrastructure. Curricula must pair code-level primitives (token standards, custody models, smart contract risks) with balance-sheet literacy (reserve accounting, duration, and liquidity risk). Administrators overseeing payments and treasury should pilot low-risk use cases in tightly scoped sandboxes, such as inter-campus settlements or restricted scholarships with conditional spending using fully reserved HKD or JPY coins, where permitted by law, with parallel redemption tests run weekly. Policymakers should undertake the necessary work to ensure private money is safe: mandate daily reserve reporting, require independent custodians, prohibit complex rehypothecation, and publish stress-testing templates suitable for narrow-duration portfolios. Align reporting to ETF-grade standards, not glossy blog posts. If you change the disclosure, you change the market—by enabling banks and ERP vendors to plug these assets into ordinary rails.

Choosing Where the Dollar Meets Asia

The statistic that initiated this discussion—US stablecoins commanding 99% of the fiat-backed market value—highlights a strategic imbalance: the dollar is already the primary currency within the monetary internet. Asia doesn't need to "conquer" it to safeguard its interests; it simply needs to decide where and how it engages with it. Hong Kong, with an HKD coin regulated under HKMA supervision and pegged to the dollar, provides a controlled counterpart for dollar liquidity that can adhere to the city's regulations while facilitating interactions with RMB channels. Japan, equipped with a transparent legal framework and a strong reserve asset in JGBs, can issue a reliably safe yen coin tailored for remittances, merchant transactions, and institutional treasury management. Everything else, including CBDCs, should be structured around this reality rather than in denial of it. The US has transitioned from hesitation to active implementation. Asia's viable options are available. They are finite. In this competition, just two systems—HKD and JPY—are sufficient to make a difference, but only if they are introduced with the accountability of public funds, not the bravado of private technology.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank for International Settlements (BIS). 2024. "Project mBridge Reached the Minimum Viable Product Stage." BIS Innovation Hub (updated November 11, 2024).

CoinDesk Data. 2025. Stablecoins & CBDCs Report — July 2025. August 5, 2025.

Coin Metrics. 2025. "Stablecoin Sector Analysis." State of the Network, May 13, 2025.

FXC Intelligence. 2025. The State of Stablecoins in Cross-Border Payments, 2025. July 17, 2025.

Hong Kong Monetary Authority (HKMA). 2024. "HKMA Commences Phase 2 of e-HKD Pilot Programme." September 23, 2024.

Hong Kong Monetary Authority (HKMA). 2025. "Regulatory Regime for Stablecoin Issuers (Stablecoins Ordinance effective August 1, 2025)."

HKMA. 2025. "Robust and Sustainable Development of Stablecoins." Insight, June 23, 2025.

International Monetary Fund (IMF). 2025. "Decrypting Crypto: How to Estimate International Stablecoin Flows." Working Paper 2025/141, July 11, 2025.

Japan, Ministry of Finance (MOF). 2025. JGB Newsletter, April 14, 2025; June 23, 2025.

Japan Financial Services Agency (FSA). 2025. "Status of Legal Framework Development for Cryptoassets (PSA and revisions)." April 10, 2025.

Kaiko Research. 2025. "USDC Outpaces Rivals; EUR Stablecoins Rising." May 5, 2025.

People's Bank of China (PBoC). 2025. "Cross-border investment has become more active…" June 18, 2025; July 7, 2025 statistical update.

Reuters. 2025. "Japan Startup JPYC to Issue First Yen-Pegged Stablecoin after License." August 19, 2025.

Reuters Breakingviews. 2025. "China Stablecoin Push Is Better Late Than Never." August 22, 2025.

SWIFT. 2025. RMB Tracker: July & August 2025.

Treasury Borrowing Advisory Committee (TBAC), US Treasury. 2025. "Digital Money" Slide Deck (2Q 2025). April 30, 2025.

United States, Financial Times (Letters/News). 2025. "Stablecoin door is open, but the horse hasn't bolted"; "U.S. banks lobby to block stablecoin interest." Aug 2025.

UN COMTRADE via TradingEconomics. 2025. "China Exports 2024: $3.58 trillion."

Bond Connect Company Ltd. 2025. "Bond Connect Flash Report — July 2025." August 18, 2025.

Comment