Beyond Cash Flows: How to Teach the Valuation of Token Networks

Input

Modified

Token value comes from network use, not only cash flows Teach Metcalfe-style metrics—active users, adjusted settlement, fees and ETF signals—with transparent filters Update curricula to pair demand-based valuation with risk and regulation

If we evaluate value solely through discounted cash flows, the $5.7 trillion that fiat-backed stablecoins processed on public blockchains in 2024 looks insignificant in the global payments landscape. However, this figure—adjusted to exclude apparent bot activity and wash flows—represents a significant shift of transactional demand onto open networks that offer programmable settlement, clear audit trails, and near-instant finality. It illustrates a simple yet inconvenient truth for traditional valuation methods: in token economies, usage is not a minor detail; it is the main asset. When no one uses a token, its value becomes irrelevant. However, when millions do use it, network effects build up similarly to compound interest. Education policy and finance courses that view tokens as merely "speculative cash-flow oracles" or "worthless code" are missing an important point. We should prepare students to assess networks—where attention, user adoption, and actual settlement create lasting value signals—even when the underlying asset offers no dividends.

From Cash Flows to Connections

Finance courses generally begin by discussing the present value of expected cash flows. This approach works for dividend-paying stocks or amortizing debt, but falters for assets whose value mainly lies in the right to transact or shape expectations. Tokens fall somewhere in between. Some protocols have clear fee structures, buybacks, or burns in place. Others, like Bitcoin, do not. Still, both exhibit measurable and meaningful demand. The best approach in the classroom is not to force every token into a dividend discount model but to present a dual perspective: one for tokens with contractually linked cash flows and another—our focus here—for "network-native" value that arises from usage and settlement guarantees. This perspective considers observed adoption and the ability to create value as primary factors, not as afterthoughts or mere perceptions. It shifts the question students ask from "What are the earnings?" to "What is the network's marginal and total utility, and how flexible is user participation?"

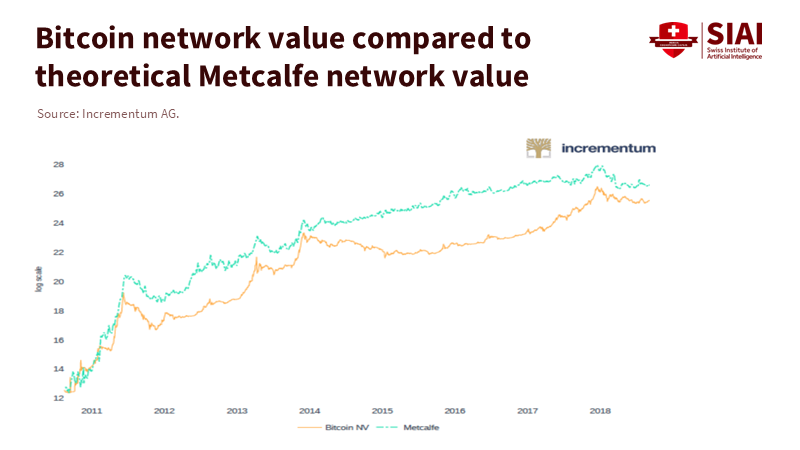

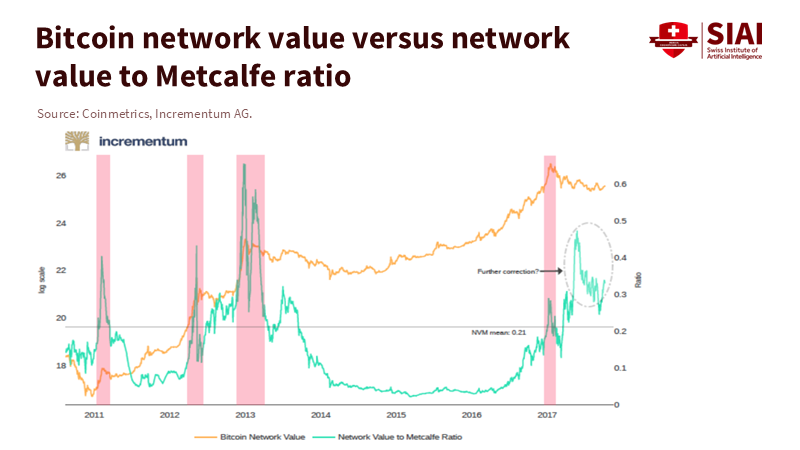

This is where well-known but often under-taught tools become relevant. Metcalfe's law, adapted from communication networks, suggests that a network's value increases with user connections—usually represented as proportional to the number of users squared (or a sub-quadratic exponent in practice). In the study of digital assets, this law has been applied to Bitcoin with reasonable accuracy over medium time frames. At the same time, the Network Value to Transactions (NVT) ratio compares market value to actual on-chain activity, similar to a price-to-sales ratio. The methodology matters: treat "users" as active, fee-paying addresses instead of raw wallets; utilize rolling, adjusted transfer volume; and test exponents between 1.5 and 2.0 instead of assuming precise square-law scaling. Students should understand that these are models of demand, not mystical constants—helpful because they assess network health in ways that discounted cash flow cannot.

Recent shifts in market structure strengthen the case for a network-first approach. The approval of U.S. spot Bitcoin exchange-traded products in January 2024 did not create new cash flows. Still, it converted hidden demand into a tradable asset at scale, influencing when and where liquidity is concentrated and how benchmark prices are set. Within the first year, these funds attracted tens of billions in net inflows, with trading focused around the U.S. market close due to NAV fixing windows—a clear example of market dynamics affecting observed usage without changing protocol cash flows. Meanwhile, on-chain activity has occasionally lagged behind price, serving as a reminder that "use" now includes both on-chain settlement and off-chain exposure. Valuation education should help students develop a comprehensive understanding of the market, equipping them with the knowledge and competence to reconcile these facts rather than selectively focus on one measure while ignoring others.

Building a Syllabus for Network Value

A practical syllabus starts with data hygiene. Present students with two conflicting claims regarding stablecoin scale: one, that total transfer volume reached tens of trillions in 2024–2025; the other, that adjusted, spam-free estimates are closer to mid-single-digit trillions for 2024. Then guide them through the filters. Which chains and assets are included? How are self-swaps, contract churn, and high-frequency loops filtered out? Why do "trading volume" and "payments volume" differ? The goal is not to label one figure as "true," but to teach triangulation: pair a conservative adjusted series (e.g., Visa’s Onchain Analytics) with a broader figure that captures the upper limit of possible economic activity, and require students to explain the discrepancy. This exercise equips graduates to avoid both over-claiming and under-estimating—mirroring the challenging choices analysts face when refining point-of-sale data or web traffic logs.

Next, teach valuation through decomposition. For protocols with explicit fee capture or scarcity based on burns, students can estimate "platform revenues" by applying a take-rate to observed throughput and then adjusting a normalized run-rate using scenario analysis. For network-native assets without such cash flows, substitute revealed willingness to pay for access and assurance. In the case of Bitcoin, willingness is reflected in miner fees paid for settlement priority, in institutional exposure facilitated through ETFs, and in consistent demand during periods of risk. None of these produces dividends, but all reflect demand pricing. A module could combine hourly fee charts with ETF primary market creations and NAV fixing windows to demonstrate how off-chain wrappers and on-chain demand interact. The goal is not to force a discounted cash flow model where one doesn’t exist, but to relate the price to usage: the costs users incur to ensure settlement and the capital institutions allocate for exposure serve as observable indicators of value, even without cash flows.

Finally, provide students with real-time, evolving metrics and encourage them to argue both sides of the issue. Lightning Network capacity increased significantly from 2020 but has decreased since late 2023; on-chain activity sometimes resembles a ghost town compared to price; and stablecoins, despite their speed and scale, face skepticism from central banks. A good capstone project could ask: "Has network utility expanded or diminished?" Require students to support their position with metrics (addresses paying fees, median transfer size, adjusted settlement volumes, ETF net flows) and institutional signals (central bank warnings, policy roadmaps). Importantly, evaluate the methodology as much as the conclusions. Suppose we want graduates to value token networks responsibly. In that case, we must emphasize the explicit assumptions, conduct sensitivity analysis, and maintain humility about what the data can and cannot reveal, thereby fostering a sense of caution and responsibility in the audience.

Policy and Administrative Implications

Education leaders should not confuse “teaching crypto” with promoting it. The goal is to build institutional capacity for network analytics, much like business schools have developed expertise in market microstructures and corporate finance. This starts with ensuring data access: negotiate academic licenses with providers that track fee-paying addresses, adjusted transfer volumes, and exchange microstructure; maintain a repository of cleaned time series with documented filters; and make sure ethics reviews cover wallet privacy, web-scraped data, and any student projects that involve live networks. Equip classrooms with straightforward dashboards for stablecoin flows and ETF primary-secondary imbalances so students can see how regulatory events affect markets. The aim is to cultivate a method-oriented culture that treats blockchain data like any other economic series—neither mystical nor less rigorous.

Policymakers and university leaders share a parallel role: contextualizing network-based value within a risk framework. International organizations have warned that widespread adoption of cryptocurrencies could disrupt monetary policy transmission and capital flow management, and that privately issued stablecoins may not meet the core criteria for "singleness" and settlement finality. This does not change the fact that stablecoin use is growing nor that tokenized finance may enhance cross-border settlement and programmability. It means that understanding valuation must go hand in hand with understanding regulation. A strong program will teach both how to interpret the technical information central banks publish on tokenization and unified ledgers and how to translate those frameworks into practical expectations about what networks can sustain over time, under stress, and at scale.

Expect challenges, and prepare students to address them on solid ground. "No cash flows, no value" is a straightforward assertion in a lecture hall. However, markets are already revealing prices for access and assurance: ETFs saw inflows of tens of billions in their first year; filtered data still indicates multi-trillion-dollar settlements on public rails; and secondary literature now explores EVM-based networks with Metcalfe-like dynamics. On the other hand, "use equals value" can sometimes be overstated if that use is circular, manipulated, or subsidized. This is why methodological notes—concerning address quality filters, wash-trade exclusions, and throughput adjustments—should be central to the curriculum. Ultimately, the real objection is not that demand-based valuation is invalid. The genuine concern is that it is easy to mishandle. This is precisely why education must approach it with care.

We can also question what "intrinsic" means in a programmable system. In a landscape of bearer-style digital assets, settlement itself constitutes a service. Users pay for queue priority; institutions pay to maintain exposure in regulated assets; developers pay for block space to deploy code. None of these payments guarantees dividends to token holders, but they do indicate a willingness to pay for the network's features. In traditional finance, we comfortably evaluate scarce assets based on the demand they generate—such as urban land, premium spectrum, and prime shelf space—even without a perfect stream of dividends. The objective in the classroom is to help students recognize that some tokens function more like digital spectrum licenses than like perpetual bonds, and that our models must adjust accordingly. Once this understanding is in place, the data—addresses, adjusted volumes, fees, take-rates—will naturally fit into our toolkit.

The best way to avoid vague assertions in token valuation is to begin with where the money actually flows. In 2024, at least $5.7 trillion moved across public chains in fiat-backed stablecoins, even after removing explicit spam. Regulators approved spot Bitcoin ETFs a few months earlier, and institutions continue to allocate funds. You can choose to view that as mere hype. Or you can recognize it for what it truly is: revealed demand for programmable settlement and exposure. If we focus our curricula on demand—network size and quality, willingness to pay for settlement, and the connections between on-chain use and off-chain assets—we provide students with a sustainable way to value tokens as networks. This approach does not romanticize code or minimize risk; instead, it ties valuation to actual behavior. The call to action is clear: update the curriculum. Teach discounted cash flows when they exist, when they do not, teach demand. Regardless, teach the method—with filters, sensitivity checks, and humility—so that tomorrow's analysts can differentiate between a trend and a temporary phenomenon.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Bank for International Settlements. (2023). Annual Economic Report 2023, Chapter III: Blueprint for the future monetary system: improving the old, enabling the new. Basel: BIS.

Coin Metrics. (2017). An introduction to MTV (now NVT).

Congressional Research Service. (2024, Jan. 19). SEC Approves Bitcoin Exchange-Traded Products (ETPs).

Fidelity Digital Assets. (2025, Feb. 13). The Lightning Network: Expanding Bitcoin Use Cases.

Glassnode. (2025, June 19). The Week On-chain, Week 24: An On-chain Ghost Town.

International Monetary Fund. (2025, May 23). Crypto-Assets Monitor: Special Feature—Stablecoins.

Investopedia. (2025, Jan.). Spot Bitcoin ETF—Biggest Winners and Losers One Year On.

Kaiko Research. (2024, June 27). BTC ETFs’ Impact on Spot Market Structure.

Kaiko Research. (2025, Jan. 16). How BTC ETFs Reshaped Crypto.

Peterson, T. (2018). Metcalfe’s Law as a Model for Bitcoin’s Value (SSRN Working Paper).

Securities and Exchange Commission. (2024, Jan. 10). Statement on the Approval of Spot Bitcoin Exchange-Traded Products (Chair Gary Gensler).

Visa. (2025, July 31). Update on Key Digital Asset Technologies (Visa Onchain Analytics; adjusted stablecoin volume estimates).

World Economic Forum. (2025, Mar. 26). Stablecoin surge: Reserve-backed cryptocurrencies are on the rise.