The Petroyuan Energy Nexus Is a Sanctions Byproduct, Not a New Bretton Woods

Input

Modified

Sanctions pushed Russian energy to Asia, forming a petroyuan-leaning nexus Yuan and dirham settlement grew in this corridor, but the dollar remains dominant Policy should shrink discount arbitrage, target shipping/finance nodes, and steady dollar finance

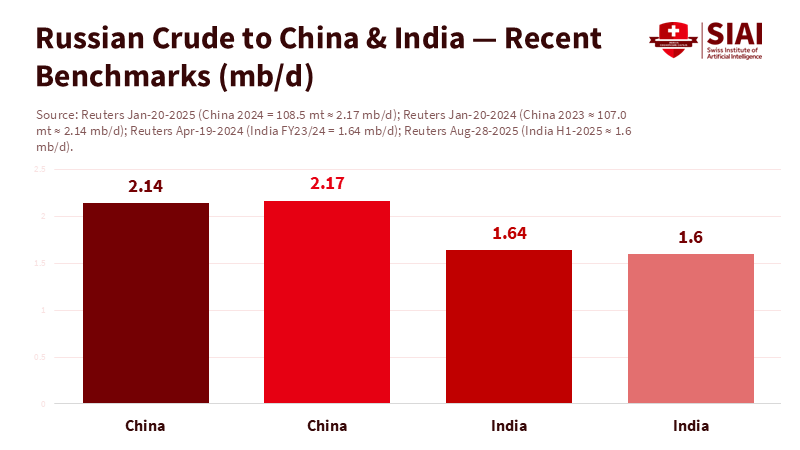

One figure sums up the situation: 2.17 million barrels per day. That’s the amount of crude China imported from Russia in 2024. This resulted in a record 108.5 million tonnes, making Moscow China’s leading supplier, even as China’s total oil imports dropped. The reason is straightforward: discounts due to sanctions. The impact is significant. It has created a closer petroyuan-based energy connection among Russia, China, and increasingly, India. India sourced about 36-40% of its crude from Russia at various points in 2024-2025, reaching a peak of nearly 1.9 million barrels per day and remaining around 1.5 million barrels per day as of October 2025. These figures show more than just temporary trade shifts; they indicate the emergence of a new clearing zone where the yuan and dirham play a greater role, while the dollar plays a lesser one. This shift isn’t a new monetary system yet. Still, it marks a substantial change in how energy trade is priced, financed, and settled under the pressure of sanctions. It gives Beijing leverage, keeps Moscow afloat, and complicates Washington’s approach.

Sanctions Built the Petroyuan Energy Nexus

The energy nexus came together because sanctions redirected oil, rather than through any signed agreement. After Europe turned away from Russian oil in 2022, China and India seized the opportunity to purchase it at discounted rates. By late 2023, Russia's Urals crude dropped below the G7’s $60 price cap, reducing monthly export revenues and allowing Asian refiners to lock in better deals. This trend continued into 2024, as Russian crude and products remained cheaper than Middle Eastern prices. In short, sanctions created a two-tier market. That’s the essence of the petroyuan situation: affordable oil combined with alternative payment solutions leads to changes in settlement practices.

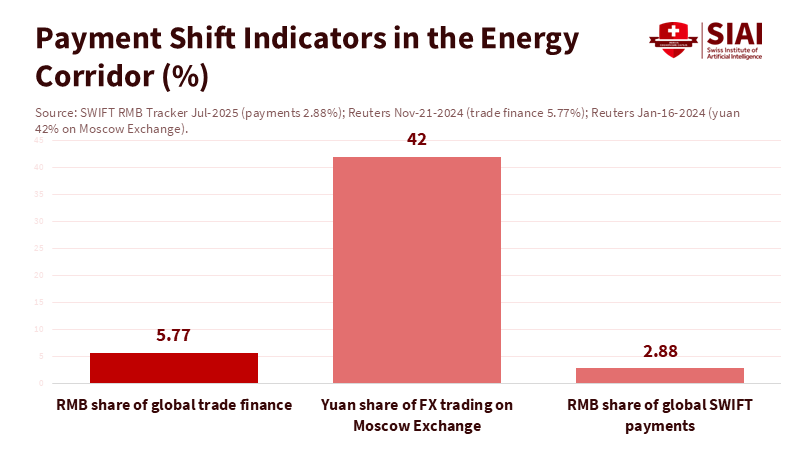

Settlement followed the flow of oil. Indian refiners began paying for Russian crude in UAE dirhams rather than dollars in early 2023, a habit that has persisted. Russia and China took it a step further. In Moscow’s currency market, yuan transactions accounted for 42% of trades in 2023, surpassing those in dollars. Analysts suggest that the yuan's share in Russia’s international trade stabilized at around 30% as the ruble's use increased, a significant jump from pre-war figures. Each of these moves diminishes the dollar’s “only game in town” status in part of energy finance, but none alone can fully replace it.

The pipeline map shows this change more clearly. The Power of Siberia transported 22.7 bcm of Russian gas to China in 2023 and about 31.1 bcm in 2024, with flows increasing toward the line's design capacity of 38 bcm. More gas flowing east means more extended contracts priced in currencies preferred by Beijing and more hedging in Shanghai. This physical shift encourages a financial change. In this order—first the molecules, then the money—the petroyuan is gaining real, though limited, momentum.

How Much De-Dollarisation? Less Than the Hype, More Than Before

There is much talk about a dollar collapse, but the data show a gradual change. RMB payments accounted for 2.88% of global SWIFT activity in June 2025, making it the sixth-most-used currency. It accounted for about 6% of international trade finance by late 2024, up from pre-war levels, yet still far behind the dollar and the euro. Meanwhile, trade between China and Russia grew again in 2024, but only by 2.9% in value, amid ongoing bank sanctions. The evidence suggests that sanctions have increased the costs of dealing in dollars and opened up more options for using the petroyuan and dirham. Still, the overall system remains focused on the dollar. Liquidity, trust, and legal clarity still favor the U.S. currency.

Looking at commodities, China’s crude imports from Russia set new records in 2024, and India’s purchases surged throughout 2024, remaining high in 2025. As those barrels move east, commercial actors are trying out non-dollar payment methods. However, the changes are more regional and functional rather than systemic. Most cross-border transactions are still cleared in dollars, most commodity derivatives still use dollar benchmarks, and most corporate treasuries prefer dollar assets. Even those who support the petroyuan acknowledge that capital control and policy uncertainty limit its reach. This creates a dynamic in which local strength in yuan-based transactions within the Russia-China-India triangle coexists with the dollar's global dominance.

This is why calling the current shift a “new Bretton Woods” misunderstands the foundations of monetary power. Bretton Woods was based on a treaty-supported system, underpinned by U.S. fiscal strength, open markets, and a large, rules-based trading bloc. What we see now is modular. It consists of trade routes shaped by sanctions, bilateral energy agreements, and gradual changes in payment practices using the petroyuan or dirhams. This is a multipolar structure, not a new gold standard. It is fragile, depending on discounts, bank compliance tolerances, and Asian buyers' willingness to take on secondary sanctions risks.

India’s Balancing Act, U.S. Pressure, and the Limits of Coercion

India is at the center of this situation. Lower-priced Russian crude saved Indian refiners billions and reduced OPEC's share of the Indian market to historical lows in 2023-2024. In 2025, Russian barrels still accounted for about a third of India’s imports. However, monthly volumes now vary with prices, freight, and financing options. Washington has attempted to persuade New Delhi to shift away from this, using everything from price caps and sanctions enforcement to more vocal diplomacy in 2025, but the results have been mixed. India has indicated it will continue buying when prices are favorable and risks are manageable. It has relied on dirham channels to keep the oil flowing. While petroyuan transactions are less crucial for India than for Russia, the practice of using non-dollar methods is now ingrained.

One reason for the lack of effective coercion is that alternatives are available. India can shift between Russian grades, Middle Eastern suppliers, and even Venezuelan oil when sanctions ease. As long as Russian discounts continue and enforcement remains lax, India prefers diversification over a complete break. Another reason is that this nexus spans multiple sectors. Defense ties, existing platforms, and spare parts keep New Delhi connected to Moscow beyond just oil, making it difficult to sever ties quickly without significant Western compensation. This limits the effectiveness of any tariff-driven strategy, pushing India to hedge even more. U.S. pressure may reduce volumes slightly, but it has not yet disrupted the partnership that supports the petroyuan energy flow.

The third reason lies in structural inconsistencies over time. The United States seeks to lower Russian revenues without causing a price increase; India wants affordable energy; and China seeks to guard against financial sanctions. These aims often conflict when enforcement tightens. Each month, crude spreads, shipping insurance costs, and transport availability change the possibilities. In this unstable environment, petroyuan and dirham payment channels offer relief. They don’t replace dollar-based systems entirely, but they help maintain oil flow when traditional methods get blocked.

What This Means for Classrooms, Campuses, and Policy

For educators, the petroyuan energy nexus serves as a real-life example of how sanctions affect trade structures. It teaches students that currency dominance is based on use, not just prestige. Assignments should focus on four main aspects: volumes, prices, payment methods, and legal risks. In 2024-2025, China’s record imports of Russian crude, India’s significant yet price-sensitive purchases, and Russia’s shift to yuan-based currency transactions create a solid data foundation. The policy perspective is straightforward: where oil flows, payment experiments will occur; where payment innovations take place, habits will solidify. This is how micro-blocs are formed.

For administrators, procurement and risk management courses should include real documents and analytical tools, like tracking RMB payments through the SWIFT system, reviewing customs bulletins, and examining tanker-tracking data for volumes. The key takeaway is that even a 2-6% share in payments can have a significant impact if concentrated in strategic areas like Russia-China energy. A small slice of global transactions can wield considerable local influence. This illustrates the petroyuan's current strength.

For policymakers, the implications are split into immediate actions and longer-term strategies. For immediate action: reduce the discount gap by tightening enforcement without causing price increases; target shipping and service nodes that facilitate non-dollar flows; and work with India on predictable waivers linked to price ranges rather than blanket bans. For the long term: enhance the dollar system’s attractiveness where it matters—maintain deep, open markets; minimize legal uncertainties; and broaden access to trade finance for smaller refiners in dollars. The more dependable the dollar system is, the fewer reasons buyers will have to explore petroyuan options.

Critics argue that gains for the yuan are superficial and reversible. They point out that capital controls remain strict, legal transparency is limited, and SWIFT share remains small. All true, and all evident in the data. However, this critique overlooks the concept of path dependence. Russia’s FX market has been fundamentally altered; long-term contracts for Power of Siberia gas are in place; and Chinese refiners have adapted supply chains to leverage yuan settlements. Even if oil volumes decrease, the ability to settle in non-dollar terms remains. The question isn't whether the petroyuan will dominate globally; it’s whether it will become influential in specific corridors important for pricing and leverage. Right now, it does.

We started with 2.17 million barrels per day and the assertion that sanctions created a petroyuan energy nexus. The evidence supports this claim: record imports of Russian crude by China in 2024, sustained purchasing by India through 2025, the yuan's growing role in the Moscow Exchange and a portion of global trade finance, dirham payment methods ingrained in India’s financial practices, and a pipeline system pulling settlement eastward. None of this displaces the dollar. However, it does reshape the landscape of monetary power, forging a tightly connected zone among Russia, China, and India in energy and finance more than at any time in the past fifty years. The role for educators is to convey complexity rather than exaggeration; for administrators, to train students in data; for policymakers, to compete effectively by ensuring that dollar financing is cheaper, more stable, and fairer where it matters. If sanctions persist, so will the habits that sanctions fostered. And these habits—rather than the headlines—are how a petroyuan era takes hold quietly, in the background.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Carnegie Endowment for International Peace. (2024). What Are the Limits to Russia’s “Yuanization”? (noting yuan at 42% of Moscow Exchange FX trades in 2023).

Centre for Eastern Studies (OSW). (2025). China–Russia Dashboard (estimating ~30% CNY share in Russia’s international trade).

Global Energy Monitor. (2025). Power of Siberia Gas Pipeline (deliveries to China: 22.7 bcm in 2023; 31.1 bcm in 2024; ramping toward 38 bcm).

International Energy Agency. (2023–2024). Oil Market Reports (Urals below the $60/bbl cap in Dec 2023; price-cap context and product caps).

Reuters. (2024–2025). China’s crude oil imports from Russia reach record high in 2024 (108.5 mt; ~2.17 mb/d). India’s Russian oil imports rise/fall (monthly flows ~1.5–1.9 mb/d; ~36% share). China–Russia trade value in 2024 (growth and payment hurdles).

SWIFT. (2025). RMB Tracker (July 2025) (RMB 2.88% of global payments by value). Deutsche Bank Research note (2025) (RMB ~6% of global trade finance by end-2024). War on the Rocks. (2025). Guns, Oil, and Dependence: Can the Russo-Indian Partnership Be Torpedoed? (analysis of U.S. pressure and Russo-Indian ties).

Westpac/Reuters wires (via Reuters). (2023). Indian refiners pay traders in dirhams for Russian oil.

Comment