Transatlantic Investment Risk: Why Europe's Firms Keep Spending While Forecasts Miss the Next Shock

Input

Modified

EU firms keep investing despite weaker growth and falling U.S. exports A strong euro, new tariffs, and Asia’s overcapacity raise transatlantic investment risk Policy and education must pivot to risk skills, energy efficiency, and faster adaptation

Europe's firms are still writing checks. In the latest EIB Investment Survey, 86% of EU companies report they are investing, nearly the same as last year. This occurs despite cooler growth expectations and high uncertainty. In August 2025, EU exports to the United States dropped 22% year-on-year to €32.9 billion, the lowest point since 2021. At the same time, the euro has hovered around $1.17 per €1, affecting price competitiveness as new tariffs take effect. The situation is clear: resilient capital expenditure alongside a tougher trade environment and a stronger currency. The reason is that transatlantic investment risk has become a permanent condition, not just a temporary hurdle. Firms are investing to adjust, focusing on intangibles, efficiency, and resilience. Our forecasting tools lag behind rapid changes in exchange rates, trade policy, and the impacts of Asia on Europe. If policy and education systems do not respond to this risk, capital will become defensive, leading to lost market share and lower productivity in Europe.

Transatlantic investment risk is rising even as capital expenditure remains steady

Europe's investment engine has not stalled, but it is functioning differently. The EIB reports that 86% of EU firms invested in 2025, down from 87% in 2024. The net balance of firms expecting to increase investment has dropped from +8% a year earlier to +4%. The focus is shifting: 35% of EU investment now goes to intangibles like R&D, training, and software, with firms prioritizing replacement over expansion. This is a rational response to transatlantic investment risk. When the outlook darkens, firms maintain core assets, boost productivity, and develop digital abilities that can cross borders without tariffs. Large companies and manufacturers still lead, but construction has reduced activity. On both sides of the Atlantic, geopolitics anchor expectations, though the adjustment is more pronounced for U.S. firms, which report a more significant drop in sentiment. Europe remains steady, redirecting spending towards resilience rather than sheer capacity.

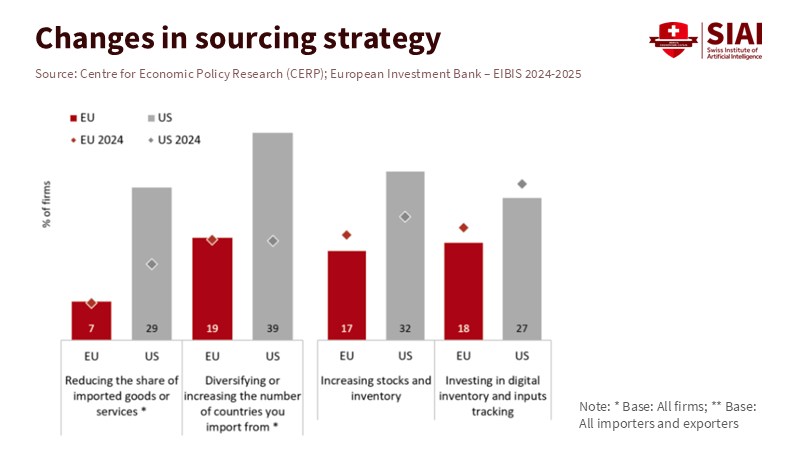

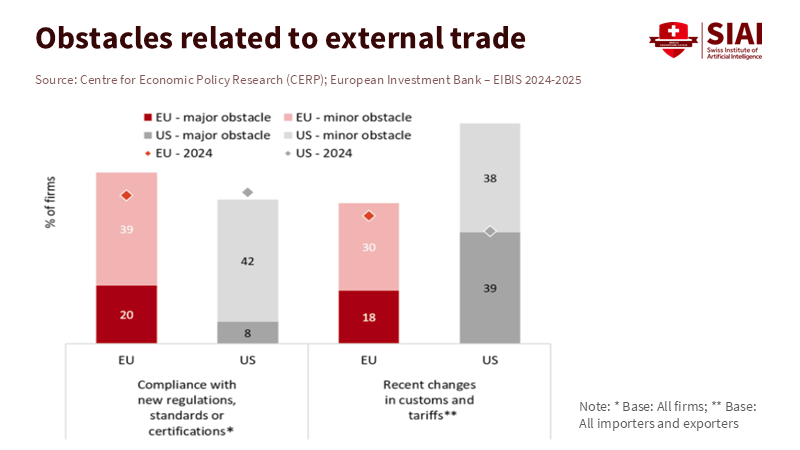

The business landscape explains why companies invest amid turbulence. Uncertainty is the chief obstacle for 83% of EU firms, followed by skill shortages (79%) and energy costs (75%). This hierarchy influences spending decisions. Firms invest in software, automation, and training to combat talent shortages. They upgrade equipment to lower energy consumption. They also diversify supply sources and inventory systems to manage shocks. However, few are hitting the brakes. Only a small portion of EU importers are actually cutting back on imported inputs; instead, more are diversifying their sources and improving inventory tracking. In simple terms, investment is now essential for staying competitive. It's not about excitement; it's about maintaining competitiveness amid transatlantic investment risk. This risk manifests daily in currency fluctuations, tariffs, and logistics quotes rather than just in long-term plans.

A robust euro and new tariffs create a two-way impact on transatlantic investment risk

Currency and tariff shocks amplify each other. In late September, reporters noted a sharp decline in EU exports to the U.S. as new U.S. tariffs coincided with a stronger euro, making European goods more expensive for American buyers. By mid-October, the ECB reference rate placed the euro near $1.17, a level that reduces profit margins for sectors like machinery, autos, and chemicals that operate on tight margins. Eurostat's latest release shows that extra-EU exports fell by 6.7% year-on-year in August 2025, indicating a broader slowdown. For companies, this combination poses immediate revenue risks in the U.S. market and alters the return calculations for projects aimed at American demand. The surprise is that investment has not plummeted; instead, it has shifted towards intangible, energy-efficient, and risk-reducing assets that perform well across currency fluctuations and tariff changes. This is not optimism; it is adaptation.

The mechanics are straightforward. A stronger euro reduces euro-denominated profits from U.S. sales unless prices rise or costs decline. Tariffs introduce another layer of impact. In August, EU exports to the U.S. fell 22% year-on-year to €32.9 billion, cutting the bilateral surplus. This trend reflects not only demand weakening but also policy tensions. Forecasts often treat currency and tariff changes as separate events, but firms do not. They adjust their product mix, renegotiate supplier agreements, and accelerate software and process upgrades to enhance productivity. This explains why capital expenditure on intangibles is high and why replacement spending surpasses expansion. Investment continues but with a focus on protecting margins and maintaining flexibility. If we ground our analysis in this reality, we will no longer misinterpret resilience as denial. It is a strategic shift under transatlantic investment risk that will continue.

The missing dynamics: Asia's overcapacity, Pacific flashpoints, and financial fragmentation

Forecasts that guide companies and governments still miss a moving target. One gap involves Asia. When the U.S. raises trade barriers against China, Chinese exports shift more sharply towards Europe, pushing prices down and squeezing margins in markets where German and other EU manufacturers compete. This pressure does not wait for official data; it shows up in purchase orders and discount schedules. Analysts warn that the EU is facing geopolitical and economic risks not seen in centuries, especially from Pacific events outside its control. Potential shocks—conflict risks, export controls, and changes in shipping routes—affect European costs and delivery times. Forecasts based on average trade patterns struggle as the trade landscape evolves. The Geneva Report on the World Economy highlights another missing piece: financial fragmentation. Cross-border finance now operates with significant geopolitical influences, increasing risk and complicating capital formation.

A second blind spot is the combined effects of energy, skills, and regulations under the new trade regime. Energy costs remain a barrier to investment for many EU firms, even more so than in the U.S. Skills shortages lead to project delays or cuts. Market fragmentation within the single market adds to bureaucracy and costs. At the same time, the EU-U.S. trade relationship was substantial in 2023—€851 billion in total trade, with €503 billion in EU exports—so even small percentage changes can represent large euro amounts. When tariffs, currency shifts, and Asian pressures align, standard models underestimate the risks to market share. They also underestimate the value of the very investments that firms are making in efficiency, digital tools, and diversification. The danger is that policymakers might view "resilient investment" as a reason to do less. In reality, transatlantic investment risk makes high-quality, productivity-boosting investment even more urgent and raises the demand for skills that help execute these investments.

What educators, administrators, and policymakers must do in a world of transatlantic investment risk

Education policies need to change first. The skills barrier is significant. With 79% of EU firms citing skills shortages and 83% noting uncertainty as major obstacles, curricula should move beyond basic digital skills to applied risk skills. This includes foreign-exchange knowledge, trade-policy analysis, and supply-chain analytics using real data. Vocational and university programs can combine operations, finance, and geopolitics into short, relevant modules that businesses recognize. Apprenticeships should involve projects on hedging, tariff classification, and adapting supply chains. Educators can develop case studies around the 2025 export drop to the U.S. and the euro's near $1.17 value to illustrate how pricing, contracts, and production plans respond in real life. This approach makes graduates productive from day one and shortens the gap between investment decisions and implementation. It also builds a workforce capable of converting intangible capital expenditure into tangible productivity—exactly what this investment shift aims to achieve.

Administrators and policymakers need to remove barriers. This means addressing three issues highlighted in the survey: skills, energy, and market fragmentation. First, speed up visa approvals and mutual recognition for essential technical roles to manage transatlantic investment risk in human capital. Second, reduce the time and cost of energy-efficiency upgrades with targeted grants and improvements to grid access since energy costs halt investment for many EU firms. Third, simplify cross-border paperwork within the EU to lessen the 1.1% "bureaucracy tax" on turnover linked to market fragmentation, especially impacting SMEs. Additionally, provide clear, time-sensitive guidance on tariff exposure and stress tests for exchange rates in publicly funded projects. The goal is not to shield companies from risk, but to facilitate adjustments when challenges arise. If policy reduces barriers in areas firms cannot control, companies can continue investing in skills, software, and process redesign—assets that will protect Europe's market share when economic cycles change.

We began by noticing a striking divide: 86% of EU firms continue to invest while exports to the U.S. decline and the euro strengthens. This discrepancy is not contradictory; it shows that transatlantic investment risk is now the norm. Companies are prioritizing resilience over expansion. They are focusing on intangibles, energy efficiency, and supply-chain management because that is where returns lie amid fluctuating tariffs, currencies, and distant conflicts. Our forecasts must catch up. They should factor in Asia-to-Europe impacts, currency-tariff interactions, and financial fragmentation with greater emphasis on potential risks. Education systems should teach risk skills that blend finance, trade, and operations. Policymakers must address the barriers firms cannot eliminate on their own: skills shortages, energy demands, and internal market regulation. The call to action is clear. Treat risk as a design factor, not a shock. Then support the investments that turn risk into productivity. If we do this, Europe's resilience will transform from a temporary state into a competitive advantage.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

European Central Bank (2025). Euro foreign exchange reference rates: U.S. dollar (USD). Retrieved October 17, 2025.

European Commission (2025). EU trade relations with the United States. Retrieved October 2025.

European Investment Bank (2025). EIB Investment Survey 2025: European Union overview. Luxembourg: EIB.

Eurostat (2025). Euro area and EU international trade in goods—August 2025 release. News release, October 16, 2025.

Internationale Politik Quarterly (2025). Markus Jaeger, "Trump's America: An Economic Challenge for the EU." October 2025.

VoxEU/CEPR (2025). Geopolitical tensions and international financial fragmentation: The 28th Geneva Report on the World Economy. October 20, 2025.

Wall Street Journal (2025). "EU Exports to U.S. Drop Sharply." October 16, 2025.

Euronews (2025). "Tariffs and a strong euro are hurting Europe's exports to America." September 26, 2025.