Public Rails, Private Code: The Future of Digital Money

Input

Modified

Digital money has arrived at scale Public rails should anchor trust while markets build services Schools and regulators must prepare for multi-rail payments with privacy, openness, and interoperability

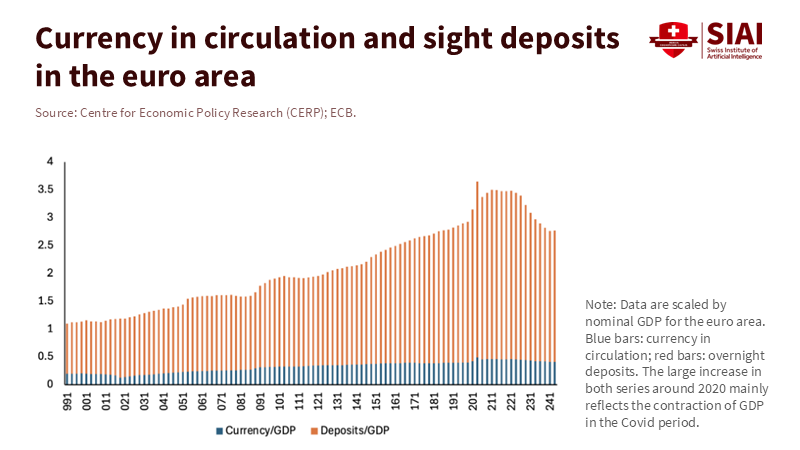

A single number captures the moment: in early October 2025, the market value of dollar-pegged stablecoins crossed $300 billion for the first time. This is not just a niche crypto story; it signals that payments, savings, and even the unit of account now operate on programmable rails and bank balance sheets. The future of digital money is no longer a theory; it is measurable, liquid, and global. In Europe, non-cash payments soared to 77.6 billion transactions in the second half of 2024. Electronic initiations outnumbered paper by about 16 to 1. Meanwhile, 137 jurisdictions, making up 98% of world GDP, are exploring central bank digital currencies, with 49 already in pilot stages. The center of gravity is shifting. Public authorities must preserve trust and stability; markets need to turn software into services at scale; educators must prepare citizens for a money system that is both public and programmable.

The Future of Digital Money Has Arrived

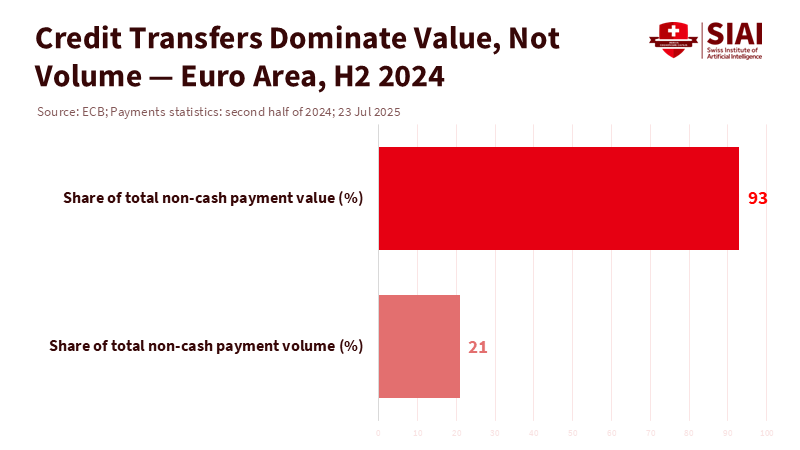

The future of digital money means something specific. It involves creating a payment and settlement layer where central bank liabilities, bank deposits, and tokenized IOUs can work together. In the euro area, the engine has already shifted. Credit transfers rose to 16.2 billion in the second half of 2024 and made up 93% of the value of non-cash payments. Mobile and app-based initiations are on the rise, especially among younger users. In the ECB's 2024 SPACE study, individuals aged 18–24 used a mobile device for 10% of point-of-sale transactions; the percentage decreases with age, but the trend is clear. We still need cash for resilience, but the living system of money is moving toward screens, APIs, and rulebooks. This shift makes money more convenient but also exposes the monetary order to code, platforms, and network effects.

This shift requires a change in policy. Central banks are not against innovation; they promote trust. In a major speech on 26 September 2025, the ECB described digitalization as an opportunity for "genuine innovations" while maintaining stability. On the same day, it published results from its digital euro innovation platform: about 70 market participants tested conditional payments, e-receipts, and accessibility features in a simulated environment. The message is clear: innovation can thrive with public money too. The Eurosystem is developing the infrastructure—through projects like Pontes and Appia for DLT settlement—so that innovation does not create isolated systems or raise merchant fees due to platform lock-in. The future of digital money should encourage creativity without undermining public anchors that ensure prices, contracts, and credit function well.

Seven Questions We Must Answer About the Future of Digital Money

Seven questions shape the discussion. First, is this the most exciting time for monetary economics in a generation? Yes, because digital assets, Big Tech, and programmable payments challenge the medium of exchange and, to some extent, the unit of account. Second, has paying interest on reserves quietly changed policy? Yes; interest on reserves allows central banks to set rates directly and separate price stability from balance sheet tools. Third, is the current system perfect? No; the zero lower bound, uncertain Phillips and IS curves, and an unobservable natural rate of interest still complicate control. These three questions remind us that technology enters an imperfect but resilient system. We should stay humble about design and clear about goals.

Fourth, should we celebrate the decline of cash? Not without question. Cash supports inclusion and resilience during crises; when power fails or networks go down, banknotes serve as a fallback. Fifth, did Bitcoin solve money? It addressed a computer-science issue—the double-spend—but remains a poor nominal anchor and an inefficient retail payment system. The true value of the crypto wave lies in what it ignited: tokenization, new infrastructures, and credible low-risk digital assets like well-regulated stablecoins. Sixth, did crypto validate Hayek's vision of competing private monies? Not really; network effects and the inherent features of money still favor a dominant unit of account. However, private competition has prompted central banks to modernize. Seventh, should we automate monetary policy with index-linked money? Digitalization makes this more possible, but the costs to contract simplicity, data governance, and policy flexibility are significant. Together, these seven questions advocate for public rails that welcome private code rather than an either/or mindset.

Public Sector and Markets: Divergent, Not Opposed, Visions

On the public side, the ECB's 2025 stance is pragmatic. It warns that concentrated platforms can turn two-sided payments markets into "winner-takes-most" systems, raising fees and limiting choice. It highlights risks from foreign-currency stablecoins and sudden deposit shifts if large stablecoins become domestic payment instruments. It also offers a constructive path: a digital euro that allows conditional payments through a reservation-of-funds function while explicitly avoiding turning public money into "programmable money" controlled by third parties. The aim is sovereignty and open access, not a state "super-app." This position recognizes the social importance of privacy, offline resilience, and legal tender, while still adopting shared ledgers for wholesale settlement and creating sandboxes for retail innovation.

In contrast, market sentiment is enthusiastic. Investor commentary presents digital finance as the engine of the next growth cycle. It cites cheaper cross-border payments, tokenized assets, and embedded finance as sources of profit. Here, the future of digital money is a story of speed and scale: $300 billion in stablecoins, 47% growth year-to-date, and increasing institutional use. Yet even optimistic narratives cannot overlook operational and governance risks. In October 2025, a major issuer accidentally minted and then burned a staggering amount of stablecoins in minutes. Although this mistake was corrected, it revealed significant concerns. Supervisors have taken notice. The Bank of England has suggested caps on retail holdings of systemic stablecoins and a resolution regime for issuers. Markets will continue to grow, but their ability to innovate depends on transparent reserves, credible wind-down plans, and safeguards that keep deposit funding stable.

Policy and Practice: A Playbook for the Future of Digital Money

For educators, the focus is on teaching students what they need to know about the system we are entering. They should understand the differences between a central bank liability, a commercial bank deposit, and a tokenized claim on a private ledger. Students should learn how conditional payments function and why the ECB differentiates them from "programmable money." They should grasp the importance of cash for resilience and recognize that privacy is a design choice, not an afterthought. In practical terms, schools and universities could pilot small-value conditional payments for fees, grants, and refunds, using compliant wallets when they become available. They could conduct tabletop exercises for payment outages. Additionally, integrating cross-border payment cases into economics, law, and computer science courses will prepare graduates for a multi-rail money system. The future of digital money is as much a civics lesson as it is a coding challenge.

For administrators, the agenda is about operation. Map payment flows by purpose (tuition, payroll, procurement, micro-transactions) and by rail (SEPA Credit Transfer, cards, wallets, potential digital-euro systems). Compare fees and settlement times; if card fees are high for small campus sales, consider alternative acceptance options that remain within regulated schemes. Prepare for an increase in account-to-account instant payments, making sure ERP systems can reconcile in real time. If national pilots for public wallets begin, volunteer controlled groups that reflect inclusion goals. Keep cash handling in the loop for reliability. Update vendor contracts to include interoperability and data portability clauses so you can leave walled gardens without disrupting service. None of this requires waiting for a digital euro launch; it just needs smart procurement and a commitment to open standards now.

For policymakers, the trade-offs are clear. The public sector should finalize the rulebook for a retail digital euro that prioritizes privacy by default, supports offline capabilities, sets reasonable hold limits to prevent deposit flight, and allows conditional payments through reservation of funds instead of third-party programmability. It should advance wholesale DLT settlement so that tokenized securities and central bank money can be combined on shared rails. For stablecoins, priorities should include daily reserve disclosures, independent audits, separated assets, and a resolution regime that ensures service continuity. Caps on individual holdings may act as a bridge as issuers develop. Above all, guard against network capture: require interoperability as a condition for market access, and enforce switching rights that allow merchants and consumers to choose freely. This is how the future of digital money remains open, safe, and competitive.

The final step is to connect vision to metrics. Track payment concentration by scheme and provider. Measure acceptance gaps for cash and digital in different regions and incomes. Monitor the share of instant and cross-border payments, refund processing times, and fraud rates per transaction. Share these numbers and update the plan. A monetary system is not a blueprint; it is a cycle of learning where policy and market practices hold each other accountable in public view. The future of digital money will belong to those who focus on what matters and adapt quickly within clear rules.

Conclusion. The headline has already changed: stablecoins at $300 billion, increasing non-cash payments, and central banks creating new systems. The question is whether we allow momentum to create a platform monopoly, or if we design public rails that keep entry open and prices fair. The answer doesn't have to be extreme. Let cash do what only cash can do. Let banks and fintech companies compete on experience and service. Allow a retail digital euro to facilitate safe conditional payments at scale while keeping public money neutral and non-programmable. Let stablecoin issuers succeed in the market only if they comply with public standards for reserves, transparency, and recoverability. If we achieve this, the future of digital money will not replace the monetary system; it will refresh it. It will transform those $300 billion headlines into lasting improvements in access, efficiency, and trust—measured not by hype, but by smoother payments, lower fees, and fewer barriers in everyday life.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Atlantic Council. (2025). CBDC Tracker. Retrieved October 2025.

Axios. (2025, October 2). Stablecoin hype grows, total supply cracks $300 billion.

Banque de France. (2025, April 18). French people still value cash, despite using it less.

BusinessInsightz. (2025, October 5). How Digital Finance Is Powering the Next Global Boom.

CEPR/VoxEU. Stracca, L. (2025, October 18). What money will become: Seven key questions.

ECB. (2025, September 26). Preparing the future of payments and money: the role of research and innovation (speech by P. Cipollone).

ECB. (2025, September 26). ECB presents findings from digital euro innovation platform… (press release).

ECB. (2025, July 23). Payments statistics: second half of 2024.

ECB. (2025). Study on the payment attitudes of consumers in the euro area (SPACE 2024).

ECB. (2025, June 30). Draft digital euro scheme rulebook v0.9.

The Block. (2025, October 3). Stablecoin market cap surpasses $300 billion for first time.

Reuters. (2025, October 15). BoE will only lift planned stablecoin cap when confident no threat.