Critical Minerals Weaponization Is Changing Education and Industrial Strategy

Input

Modified

China’s critical minerals weaponization turns midstream processing into global economic leverage Without local refining and skills, countries lose value and bargaining power Build education-led processing hubs to capture margins and reduce chokepoint risk

Ninety percent of the world’s rare earths are processed in one country. For heavy rare earths used in high-performance magnets and defense systems, that share is close to 100%. When one player controls the refinery, it becomes a policy tool. That summarizes critical minerals weaponization. The goal is rarely a complete cutoff. Instead, it focuses on using export licenses, permit delays, and vague reviews to increase costs and affect outcomes. As tariffs rise on electric vehicles, batteries, and chips, the minerals side has responded with controls on gallium, germanium, graphite, and, more recently, tungsten among other materials. This situation is not just about commodities. It tests human resources and institutions in countries that mine but do not refine and in education systems that prepare workers for yesterday's value chain instead of tomorrow's. Countries must either build the skills and plants to process ore or lose profit and influence to whoever controls midstream processes.

Critical minerals weaponization is the new trade war front

The mechanics are straightforward. First, raise the cost of access to key inputs. In 2023, China started requiring export licenses for gallium and germanium, two metals essential for radio-frequency chips and power electronics. It then introduced permit rules for various types of graphite, which is crucial for EV anodes. By early 2025, new controls included tungsten, indium, bismuth, tellurium, and molybdenum. Each step created administrative hurdles and allowed for shipment delays or denials when needed. While framed as national security, the real impact was economic control.

Second, broaden the scope and jurisdiction. Recent measures now cover not just raw ores but also refined products and equipment used in magnet and separation plants. Some regulations are similar to the U.S. “foreign direct product” rule, which claims control over goods made abroad with Chinese inputs or technology. This expansion increases compliance risks for firms in allied countries and adds uncertainty to every procurement plan. This uncertainty shifts bargaining power without the consequences of a formal embargo.

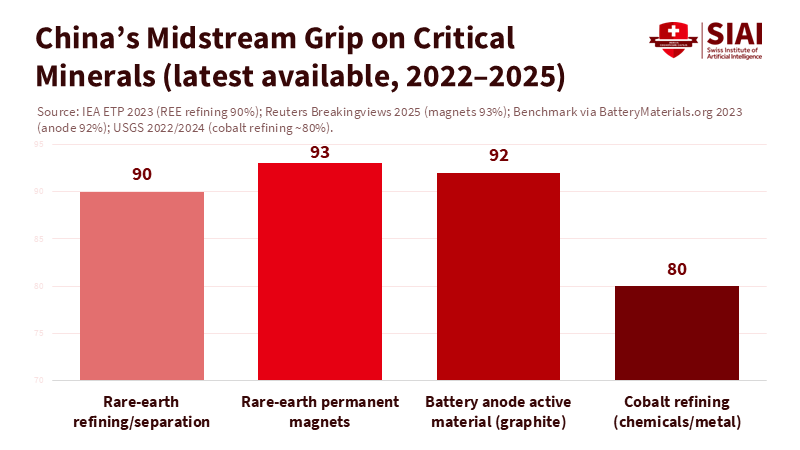

Third, convey messages through numbers. China’s share of rare earth processing remains around 90%. It also leads magnet production, controlling the essential step that transforms separated oxides into neodymium-iron-boron and other high-performance magnets. In 2025, new export licensing rules coincided with a drop in reported magnet exports and a sharper decline to the United States. The markets reacted accordingly. When magnets falter, entire downstream sectors, from automobiles to defense, are affected.

From tariffs to choke points: how the leverage operates

Trade pressure is now two-sided. In the U.S., tariffs on Chinese EVs rose to 100% in 2024. Duties on EV batteries and solar cells also increased. Semiconductors will face a 50% tariff in 2025. On the Chinese side, export controls are expanding across critical inputs. Both sides aim to shift the location of value-added production and lessen dependence on each other's strengths. The outcome creates a contest of bottlenecks: market access versus material access.

Supply concentration adds weight to this contest. The International Energy Agency estimates that 70–75% of the expected growth in refined lithium, nickel, cobalt, and rare earth supply to 2030 will come from the top three producers. For battery-grade graphite, about 95% of growth is linked to China. China processed nearly 90% of rare earths in recent years and an overwhelming majority of heavy rare earths. When development and processing are this concentrated, minor policy changes can lead to significant real-world effects—longer lead times, increased inventories, and fluctuating prices.

The minerals landscape also shows why tariffs alone cannot restore balance. China mined about 69% of rare earths in 2024 and maintains a dominant share of magnet production, a final stage with few alternatives. Meanwhile, the Democratic Republic of Congo provides around three-quarters of the cobalt mine supply; Indonesia produces over half of the world's nickel. The United States and Europe import and refine much less across these chains. Tariffs can redirect final assembly but cannot create midstream processes or metallurgical knowledge without long-term investment.

Controls and counter-controls interact in complicated ways. After China restricted gallium and germanium exports, analysts reported re-exports through third countries. New bans and stricter licensing aimed to close those gaps, while buyers began diversifying toward Australia, Canada, and recycling options. The system adapts, but challenges remain. Each iteration adds costs and delays. Companies are learning that resilience demands local or allied processing, material substitution when possible, and a workforce trained to operate and continually improve complex plants.

Turning the pressure into strategy for the Global South

For resource-rich developing countries, critical minerals weaponization presents both a danger and an opportunity. The threat is a new resource curse: price spikes, governance issues, and environmental harm without lasting local capability. The opportunity lies in developing midstream capacity—chemistry, metallurgy, and magnet production—to capture more value domestically. Recent policy moves reflect both paths. Some states have started to condition access to ore on local processing or joint ventures that involve technology transfer and workforce training. If done correctly, this can change the national income distribution and raise the floor for wages and skills. If done poorly, it can discourage investment or trap countries in operations that yield few benefits.

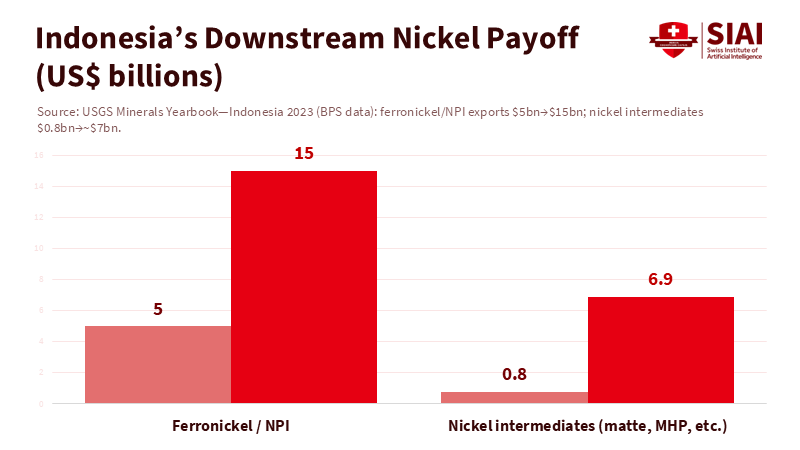

Consider Indonesia’s nickel strategy. After banning raw ore exports, the country attracted billions for smelters and conversion plants. By 2023, Indonesia produced over half of the global nickel supply. It shifted exports from ore to ferronickel, nickel pig iron, matte, and intermediates. Official trade data shows ferronickel exports rising from about $5 billion in 2020 to nearly $15 billion in 2023, with intermediates increasing as well. The policy isn't without risk—price cycles, environmental concerns, and governance challenges exist—but it illustrates how midstream investment can turn natural resources into jobs and bargaining power.

Zimbabwe and Namibia are trying similar approaches in lithium and rare earths. Zimbabwe banned unprocessed ore exports in 2022 and plans to ban lithium concentrate exports starting in 2027, encouraging investors to focus on lithium sulfate and battery-grade processing. Namibia prohibited the export of unprocessed lithium and other critical minerals in 2023 to speed up local processing. These actions matter because China has a significant edge in separation and refining technology; thus, policies must focus on partnerships that bring equipment, process control, and quality systems into local ecosystems—universities, technical colleges, and supplier networks—not just into isolated industrial parks.

The cobalt chain illustrates both the potential rewards and the risks. The DRC produced about 74% of the global mine supply in 2023, while most refining took place in China. As long as ore leaves and chemicals return, value remains abroad. The opportunity lies in creating modular refineries, precursor plants, and recycling hubs close to mines but aligned with global standards. This requires clear contracts, vigorous environmental enforcement, and public investment in skills. Without these, export bans might backfire, and smuggling could increase when prices rise.

What educators and administrators can do now.

Education ministries, universities, and technical and vocational education systems are crucial in any serious effort to reduce the impact of critical minerals weaponization. The midstream process demands skilled workers. It requires metallurgists, process engineers, analytical chemists, maintenance technicians, and environmental health and safety specialists. However, workforce studies indicate shortages in the battery and mining sectors, alongside a looming wave of retirements among seasoned engineers. Addressing this gap involves revamping curricula and credentialing systems, not just adding to investment budgets.

Three main priorities emerge. First, develop “mine-to-magnet” education pathways that connect geology and extraction with separation, alloying, and magnet fabrication. Public labs and pilot facilities allow students hands-on experience with solvent extraction, calcination, sintering, and quality control. Second, include environmental and social standards in core courses—tailings management, water conservation, worker safety, and community consent must be essential parts of the curriculum. Third, formalize partnerships with industries to secure apprenticeships and co-create micro-credentials in process control, PLC programming, and quality systems. Fast-moving countries can align these educational programs with investment incentives so that each major project supports a parallel training group.

Administrators should also reconsider where research on value chains occurs—many universities separate materials science from mining. The risks in supply need integrated institutes that connect metallurgical engineering with industrial policy, trade law, and data science. Governments can link research funding to the establishment of open-access testing facilities—places where small domestic suppliers can verify powders, oxides, and magnet specifications without sending samples abroad. This approach lowers barriers for local businesses, speeds up learning, and keeps expertise within public institutions. Evidence from labor reports related to energy transition suggests that aligning education pipelines with project pipelines can yield substantial employment benefits.

Finally, curricula should reflect the policy cycle. Tariffs will shift. Export controls will change. New substitutes—like manganese-rich cathodes, sodium-ion cells, and ferrite motors—will emerge. Programs that teach students how to interpret technical standards, navigate licensing processes, and evaluate the total cost of ownership will prepare talent for the future. Countries that combine this flexibility with transparent procurement processes and reliable energy and water supplies will attract the essential partnerships that deliver equipment, practical knowledge, and a route from ore to finished products.

The figure that opened this essay—almost complete control of heavy rare earth processing and nearly 90% of overall rare earth processing—should capture attention. Critical minerals weaponization operates because choke points exist and because skills, rather than just resources, determine who captures value. Tariffs may influence final assembly, but choke points decide who sets the terms. Developing nations can avoid a new resource curse if they develop midstream capabilities supported by education and accountable governance. Wealthy countries can lessen their vulnerability if they invest in allied processing and human resources instead of relying solely on tariffs to resolve a chemistry challenge. This approach is not quick and isn't cheap. However, it is clear. Treat mineral processing as a foundational project for nation-building. Fund the labs and training centers that support it. Create investment agreements that ensure knowledge retention. Then, when the next wave of controls or tariffs arrives, their impact will matter less—because the refinery will be nearby, staffed by graduates who know how to keep it running.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

AP News. (2025, Oct. 20). To hit back at the United States in their trade war, China borrows from the U.S. playbook.

Arezki, R., & van der Ploeg, F. (2025, Oct. 15). The new curse of critical minerals. VoxEU/CEPR.

CEPR. (2025, Oct.). Policy Insight 147: Escaping the critical minerals curse.

CSIS. (2024, Jan. 8). What China’s ban on rare earths processing technology exports means.

CSIS. (2025, Apr. 14). The consequences of China’s new rare earths export restrictions.

CSIS. (2025, Jul. 28). Developing rare earth processing hubs: An analytical approach.

IEA. (2023, Oct. 20). Announcement on the optimisation and adjustment of temporary export control measures for graphite items. Policy database.

IEA. (2024, May 17). Global Critical Minerals Outlook 2024. (Executive summary and full report).

IEA. (2025, Oct. 6). China’s share in rare earth magnet production, 2024. Data & Statistics.

InvestingNews. (2025, Mar. 25). Top 10 countries by rare earth metal production.

Miller & Chevalier. (2024, Apr. 3). Graphite export controls—China’s trade countermeasures affecting the EV market.

Reuters. (2025, Oct. 20). Fall in China’s exports of rare earth magnets stokes supply chain fears.

Reuters. (2025, Oct. 16). G7 agrees to keep united front on China export controls, diversify suppliers.

Reuters. (2025, Jun. 10). Zimbabwe to ban export of lithium concentrates from 2027.

Reuters. (2023, Jun. 8). Namibia bans export of unprocessed critical minerals.

S&P Global. (2024, Sept. 18). Indonesia—Mining by the numbers, 2024.

U.S. Department of Energy. (2024, Dec.). 2021–2024 Four-Year Review of Supply Chains for the Advanced Batteries Sector.

U.S. International Trade Commission. (2024). Germanium and Gallium: U.S. trade and Chinese export controls. Executive briefing.

U.S. White House. (2024, May 14). Fact sheet: President Biden takes action to protect American workers and businesses from China’s unfair trade practices.

USGS. (2024). Mineral Commodity Summaries—Cobalt. U.S.

USGS. (2024). Mineral Commodity Summaries—Rare Earths.

World Economic Forum, RMI, & Global Battery Alliance. (2025). Powering the Future: Overcoming battery supply chain challenges with circularity.

World Energy Employment Report. (2024, Nov. 13). World Energy Employment 2024. IEA.

Z2Data. (2025, Oct. 12). How China is weaponizing minerals—and what you can do about it.